Understanding home loans and mortgages is crucial if you want to make informed financial decisions that will boost your future. I’m here to guide you through the ins and outs of the mortgage world, breaking down the complex jargon into simple terms you can get behind. I’ll help you avoid the dangerous pitfalls that can cost you serious cash, while empowering you with the positive tools to secure the best mortgage deal possible. Let’s dive in and unlock the secrets to homeownership success together!

Table of Contents

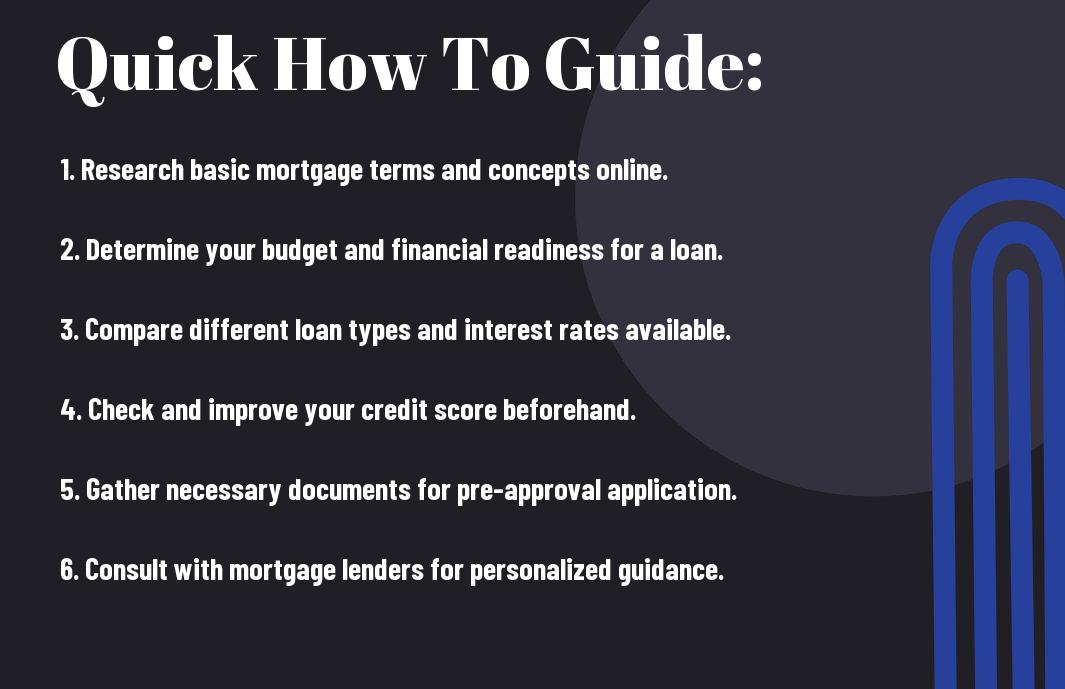

How to Understand Basic Home Loan Terminology

The journey to understanding home loans starts with mastering the basic terminology. I can’t stress how crucial it is to familiarize yourself with terms like interest rate, principal, escrow, and down payment. These words aren’t just jargon; they’re the building blocks of the financial transaction you’re about to commence on. Knowing what they mean will empower you to navigate your mortgage options with confidence and clarity. Let me break it down for you.

Key Terminology You Need to Know

The language of home loans may seem overwhelming at first, but once you dive in, it becomes easier. I promise, familiarizing yourself with phrases like fixed-rate mortgage, adjustable-rate mortgage (ARM), and closing costs can help you make informed decisions. Understanding these key terms is vital for negotiating your loan terms effectively and securing the best deal for your circumstances.

Common Misconceptions

Terminology in the home loan world is often misunderstood, which leads to a slew of misconceptions. For instance, many believe that a higher credit score guarantees the best mortgage rates, but that’s just part of the equation; your overall financial profile matters too. It’s necessary to separate fact from fiction to avoid pitfalls that could cost you thousands over the life of the loan.

Know that it’s not just about the numbers; it’s about the whole package. People think they can easily qualify for anything based on one strong aspect of their profile, but lenders look at your entire financial picture. I’ve seen folks who were blown away by how misleading some of these assumptions can be. That’s why I encourage you to do your homework, grab knowledge like a sponge, and don’t hesitate to ask questions. You’ve got this!

How to Determine What You Can Afford

Clearly, before entering into the world of home loans and mortgages, it’s crucial to figure out what you can realistically afford. This isn’t just about your dream home—it’s about your financial well-being. I’ve learned that evaluating your financial situation involves taking a hard look at your income, expenses, and savings. Do a deep probe your budget, and be honest with yourself. Ask: How much can I set aside each month for a mortgage without compromising my lifestyle?

Evaluating Your Financial Situation

With a clear understanding of your financial situation, you can confidently take the next step. This means tallying up your income and subtracting your regular expenses. It’s also a good idea to factor in costs like property taxes, insurance, and maintenance. Bear in mind, life isn’t just about numbers, so keep some room for unexpected expenses. Your goal here is to arrive at a monthly mortgage payment that keeps you financially solid without pulling you down.

Understanding the Role of Credit Scores

Even if you think you’re ready to buy, a key player in this game is your credit score. Your credit score shows lenders how reliable you are when it comes to repaying debt. It’s crucial because it impacts the interest rates you’ll get on your mortgage. A higher score can mean significant savings in the long run. You want to strive for a score of at least 620, but the higher, the better. Trust me, not understanding this can be a dangerous trap that leads to costly mistakes.

Evaluating your credit score’s impact goes beyond just numbers. It’s about being aware of how lenders interpret your financial behavior. A poor credit score can lead to higher interest rates, which increases your monthly payments and overall financial burden. On the flip side, a strong credit score can open doors to lower rates, which is a game-changer for anyone looking to buy a home. So, keep an eye on your credit history; it’s truly a vital part of your journey towards homeownership.

Tips for Choosing the Right Type of Mortgage

Not every mortgage is created equal, and that’s why finding the best fit for your situation is crucial. Here are some key tips to consider when choosing your mortgage:

- Assess your financial situation and budget

- Understand the terms and conditions of each option

- Compare interest rates from different lenders

- Consider the down payment you can afford

- Think about how long you plan to stay in the home

The right mortgage can save you thousands over time, so take the time to get it right!

Fixed-Rate vs. Adjustable-Rate Mortgages

Mortgages come in various forms, with fixed-rate and adjustable-rate mortgages being two popular choices. A fixed-rate mortgage gives you a steady monthly payment for the entire life of the loan, making budgeting a breeze. Meanwhile, adjustable-rate mortgages – well, they can start off lower but fluctuate over time, which can be risky. It’s all about weighing the benefits and your long-term plans.

Government-Backed Loans and Their Benefits

FixedRate, let’s talk about government-backed loans. These types of loans, like FHA, VA, and USDA loans, can be excellent options for many homebuyers. They often require lower down payments and private mortgage insurance, making homeownership more accessible.

Understanding government-backed loans is vital for anyone looking to buy a home. They offer amazing benefits, including lower interest rates, affordable down payment options, and favorable terms that can ease the financial burden. For first-time homebuyers or those with weaker credit scores, these loans can be a game-changer. However, be aware of potential limitations such as geographic restrictions or the need to prove eligibility. I want you to be fully informed before you take that big leap into homeownership!

Factors to Consider Before Applying for a Mortgage

Unlike many people think, getting a mortgage isn’t just about flipping through a few options and choosing the lowest interest rate. It’s a financial commitment that involves understanding various aspects of your financial situation and the broader market. Before you pull the trigger on a mortgage, here are some critical factors to consider:

- Credit Score – Your credit score will greatly influence your interest rate.

- Debt-to-Income Ratio – Lenders will look at how much of your income goes to debt.

- Loan Type – Different loans have different terms and benefits.

- Down Payment – A larger down payment can mean better loan terms.

- Market Trends – Timing can impact mortgage rates and home prices.

Knowing what you owe on your existing debts versus what you earn is vital in this process.

Loan-to-Value Ratio Explained

LoantoValue is a financial term that measures the ratio of a mortgage loan to the total appraised value of the property. This ratio helps lenders assess risk; a lower LTV usually means less risk since it implies a larger down payment. A high LTV could mean you’re putting less down and may result in higher fees or interest rates.

Importance of Pre-Approval

Factors that determine your readiness to look into homeownership include getting pre-approved for a mortgage. This process gives you a clear picture of what you can afford and establishes your credibility with sellers.

Understanding pre-approval is crucial because it puts you in the driver’s seat when negotiating. It shows sellers you mean business and you’re not just window shopping. When you’re pre-approved, it also typically means you’ve locked in a good interest rate earlier and you’ll be ahead of the game when it comes to finalizing your purchase. The last thing you want is to fall in love with a home only to realize you can’t afford it or that your finances fall short during the actual application process.

To wrap up

To wrap up, understanding home loans and mortgages is your ticket to making educated financial moves. I’ve laid out the critical steps you need to take, and now it’s your turn to dive in and own the process. Don’t just sit back and let opportunities pass you by—educate yourself, ask questions, and seize the moment to secure your dream home. Keep in mind, it’s your financial future, so take the reins and make it happen! Let’s crush it together!

One thought on “In-Depth How To For Understanding Home Loans And Mortgages 2024”