How To Secure Affordable Business Loans Many entrepreneurs feel overwhelmed by the process of finding affordable business loans, but I’m here to tell you it doesn’t have to be that way! In this guide, I’ll share my top strategies that have helped me and countless others secure funding without breaking the bank. You need to know what lenders look for and how to leverage your assets effectively to get the best terms possible. Trust me, navigating the loan landscape can be a game-changer for your business if you approach it with the right mindset and strategies!

Table of Contents

How to Prepare for a Business Loan

While seeking a business loan can be daunting, preparation is key to making the process a breeze. I want to share some crucial steps that can get you ready to secure the funds you need, so let’s dive in!

Assess Your Financial Health

If you want to get a loan, the first thing you need to do is assess your financial health. Check your credit score, review your financial statements, and take stock of your debts. It’s important to know where you stand so you can position yourself better when discussing your loan options.

Create a Solid Business Plan

There’s no denying that a strong business plan is your ticket to getting that loan approved. Without one, you might as well be throwing your money away. Lenders want to see **clear goals, detailed projections, and a robust strategy** for how you will use the funds. They want to invest in your vision, so make sure you can paint a compelling picture that demonstrates your potential for **success and sustainability**.

Business plans are not just boring documents; they’re your roadmap to success and your **best chance to convince lenders** that you know what you’re doing. You need to incorporate **detailed financial forecasts, a compelling marketing strategy**, and a clear understanding of your target market. Recall, the better you articulate how you’ll use their money to generate returns, the higher your chances of being taken seriously. And don’t forget, lenders are not just looking for numbers; they’re looking for someone **passionate and committed** to the business. So, let your dedication shine through in your business plan!

Tips for Finding Affordable Loan Options

It’s absolutely vital to secure the right affordable business loans without breaking the bank. Here are some practical tips to help you out:

- Assess your financial health and credit score.

- Compare interest rates from different lenders.

- Explore various loan types and terms.

- Network and gather recommendations.

- Read customer reviews and experiences.

Recognizing that some diligent research can lead you to incredible options is the key here.

Explore Different Lenders

Options abound when it comes to business loans. Venture beyond traditional banks, and check out credit unions and online lenders. Each lender has its unique offerings—you never know which can give you the best terms until you analyze their products. It’s always worth it to keep the doors open and explore various avenues.

Look for Government Programs

Any entrepreneur should consider tapping into government programs designed to support small businesses. They can offer loans with lower interest rates and flexible repayment terms, which might be just the edge you need.

Plus, government programs often provide grants and subsidies that do not require repayment. So, do your homework to check what’s available at the local, state, and federal levels. These resources can provide the much-needed financial support without the heavy interest burdens that private lenders impose.

Utilize Online Platforms

There’s a treasure trove of information available through online platforms. Websites that aggregate loan options and allow you to compare offers can save you time and money. It’s like having a personal assistant on your team.

Utilize these online resources to get quotes from numerous lenders quickly. The best part? You’ll find many platforms that let you pre-qualify without affecting your credit score, making it a risk-free way to discover your options. Just remember to vet these platforms thoroughly to avoid scams!

Key Factors That Impact Loan Approval

Once again, when you’re navigating the world of business loans, understanding the key factors that impact your loan approval is imperative. I’ve learned that a few specific elements play a significant role in determining whether lenders will take a chance on you. Here’s what to keep in mind:

- Credit Score and History

- Business Revenue and Cash Flow

- Time in Business

- Collateral

- Debt-to-Income Ratio

Recognizing these factors can help you better prepare for your loan application and increase your chances of securing the funds you need. How To Secure Affordable Business Loans

Credit Score and History

Any misconceptions about credit scores can cost you big time. Your credit score and history reveal your financial behavior to lenders, so a strong score demonstrates reliability and trustworthiness. Keep in mind, a majority of lenders prefer to see a score above 700, while anything below can make them hesitant to lend to you.

Business Revenue and Cash Flow

Loan applications always scrutinize the revenue and cash flow of your business. This isn’t just about how much money you’re bringing in; it’s also about how well you manage that money. A steady pattern of income assures lenders that you can repay the loan on time.

This is where I realized that understanding your cash flow is not just beneficial, it’s crucial. If you’re consistently generating high revenues, that’s a fantastic indicator, but if your cash flow is erratic or negative, it raises a red flag for lenders. They want to see that you have enough cash coming in each month to cover your expenses and your loan repayments. Keeping track of your financial health and planning for any potential dips can make all the difference when you’re knee-deep in the loan application process.

Conclusion

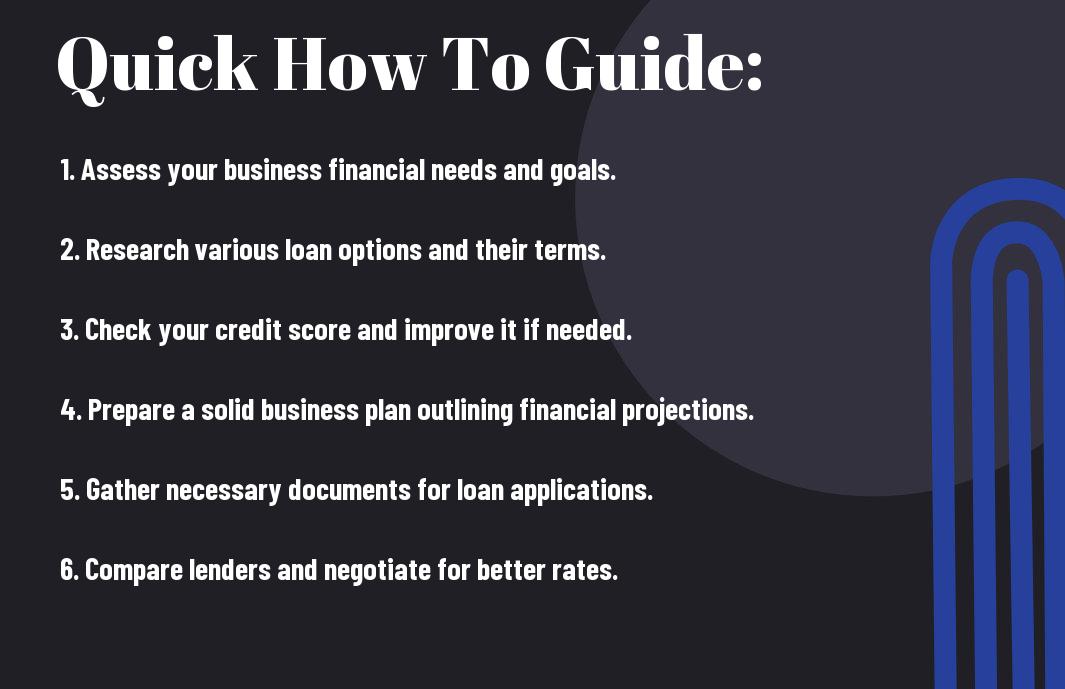

Presently, securing affordable business loans is all about being smart and strategic. I want you to hustle, do your homework, and explore every option available to you. Don’t settle for anything less than what you deserve. Check out this amazing resource on How to Apply for and Get a Business Loan in 6 Steps to empower your financial journey. Do not forget, your business dreams are waiting, and I know you can make them happen!

FAQ

Q: What are the steps I should take to secure an affordable business loan?

A: To secure an affordable business loan, follow these steps:

1. **Assess Your Needs**: Determine how much funding you need and what you will use it for. This helps to identify the right type of loan.

2. **Check Your Credit Score**: Lenders will look at your credit history. Ensure your score is in good shape to qualify for better rates.

3. **Research Lenders**: Look for traditional banks, credit unions, and online lenders. Compare interest rates, fees, terms, and customer reviews to find the most affordable option.

4. **Prepare Documentation**: Collect financial statements, tax returns, a business plan, and any other necessary documents to support your loan application.

5. **Apply and Negotiate**: Submit your application, and don’t hesitate to negotiate the terms. An offer may be more flexible than you think.

Q: What factors do lenders consider when evaluating my business for a loan?

A: Lenders assess several key factors when evaluating your business for a loan:

1. **Creditworthiness**: This includes your credit score and credit history. A strong credit history can improve your chances of securing a loan at a lower interest rate.

2. **Business Financials**: Lenders will look at your revenue, profit margins, and cash flow to gauge your ability to repay the loan. Strong financials suggest lower risk.

3. **Business Plan**: A well-structured business plan outlining how you intend to use the loan and how it will benefit your business can demonstrate your ability to sidestep risks.

4. **Collateral**: If you’re applying for a secured loan, the value of any collateral you can offer will impact your loan conditions and the interest rate you receive.

Q: Are there any specific loan types suited for small businesses looking for affordability?

A: Yes, there are several loan types specifically designed for small businesses that can offer affordable options:

1. **SBA Loans**: The Small Business Administration (SBA) offers various loan programs that typically have lower interest rates and longer repayment terms.

2. **Microloans**: Aim at smaller funding amounts, often provided by non-profit organizations. They usually come with lower interest rates, making them affordable for small businesses.

3. **Lines of Credit**: A flexible option that allows you to borrow funds as needed, usually with only interest paid on what you use. This can be more cost-effective for managing cash flow than traditional loans.

4. **Peer-to-Peer Lending**: This is an alternative funding source that connects small businesses with individual investors, often yielding competitive rates compared to traditional lenders.

One thought on “How To Secure Affordable Business Loans”