How To Repay Your Personal Loan Faster This guide is designed to help you accelerate the repayment of your personal loan efficiently. As a borrower, I understand that high interest rates can be overwhelming, but with the right strategies, you can significantly reduce your overall debt. I’ll share proven methods that not only keep you financially stable but also improve your credit score along the way. Let’s investigate some actionable steps you can take today to get on the fast track to being debt-free!

Table of Contents

Understanding Personal Loans

Before plunging into strategies for repaying your personal loan faster, it’s imperative to have a solid understanding of what personal loans are and their different types.

What is a Personal Loan?

The term personal loan refers to a type of unsecured loan that allows you to borrow money for a variety of personal expenses, such as debt consolidation, medical bills, or home improvements. These loans typically come with fixed interest rates and predetermined repayment terms.

Types of Personal Loans

The world of personal loans is diverse, and understanding the different types can help you choose the right loan for your needs. Below are some common types of personal loans:

| Type | Description |

| Debt Consolidation Loans | Used to consolidate multiple debts into one loan with a lower interest rate. |

| Fixed-Rate Personal Loans | Loans with a consistent interest rate throughout the loan term. |

| Variable-Rate Personal Loans | Loans with interest rates that can fluctuate based on market conditions. |

| Peer-to-Peer Loans | Loans financed by individual investors through online platforms. |

| Co-signed Personal Loans | Loans that require a co-signer to improve terms or access larger amounts. |

As I explore the different types of personal loans, I realize that each type has its own unique benefits and risks. Here’s a breakdown of some additional information:

- If you are looking for lower interest rates, debt consolidation loans might be a great choice.

- For predictable payments, consider fixed-rate personal loans to avoid market fluctuations.

- If you can tolerate risk, variable-rate personal loans may offer lower starting rates.

- Peer-to-peer loans provide a more personal lending experience with potentially better rates.

- If you need to secure a better rate or larger loan, co-signed loans can enhance your application.

Loan choices can significantly impact your financial journey, so being informed about types of personal loans is crucial. The right loan can offer you financial flexibility and support your goals.

How to Repay Your Personal Loan Faster

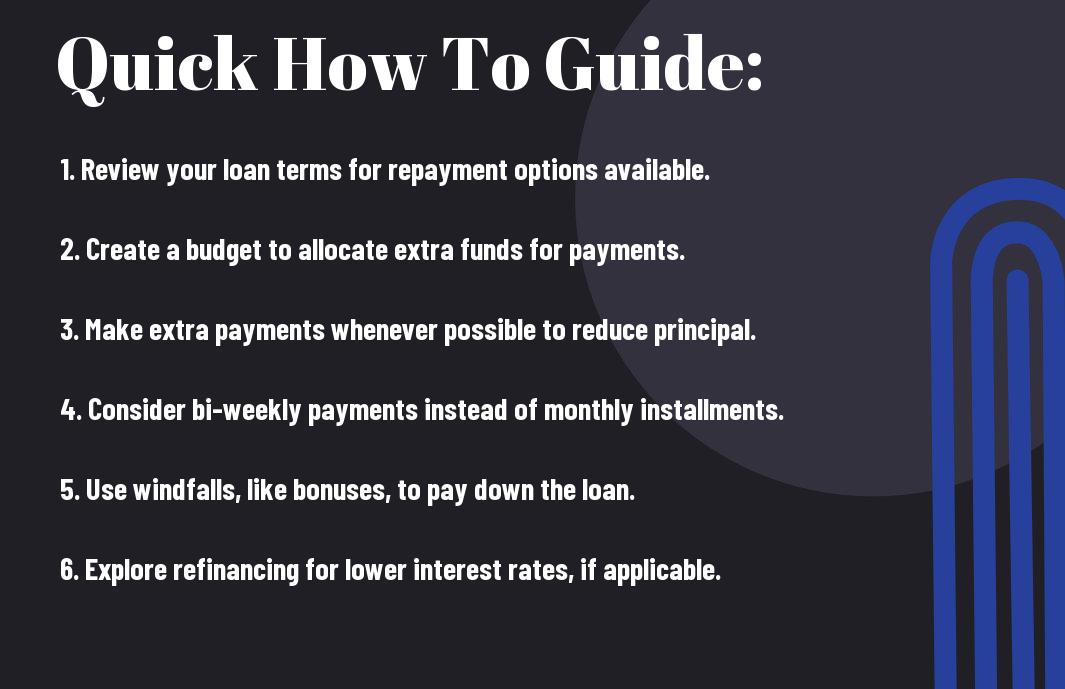

Any individual looking to repay their personal loan faster should consider the following strategies. These methods can help reduce the total interest paid and ultimately allow you to regain financial freedom sooner.

Create a Repayment Plan

Some of the most effective debt repayment strategies begin with a solid repayment plan. I recommend breaking down your loan payments into manageable monthly installments, while considering your overall budget. This plan will not only keep you organized but will also give you a clear focus on how much you need to pay each month.

Make Extra Payments

While it can be tempting to make only the minimum payment each month, making extra payments toward your principal can significantly reduce your loan term. This strategy can potentially save you a lot of money in interest over the life of the loan.

Plus, when you make extra payments, you help reduce the balance of your loan faster, which can decrease the amount of interest you owe. I advise checking with your lender to ensure that extra payments go directly toward the principal and not just toward next month’s installment. This technique accelerates your repayment journey and fosters a sense of accomplishment.

Utilize Savings to Pay Off Principal

Payments made on loans can feel burdensome, so I encourage you to consider utilizing any available savings to pay off your principal. This approach can lead to significant interest savings over time.

Utilize any bonus, tax refund, or unexpected windfall to make a lump sum payment toward your loan. This can drastically lower the amount owed and shorten your repayment term. However, always ensure that you maintain an emergency fund after applying your savings towards the loan.

Consider Loan Refinancing

Utilize the option of loan refinancing if you find yourself struggling with high-interest rates. Refinancing can lower your interest rate, potentially saving you significant amounts in the long run.

Extra research on competitive interest rates can yield better loan terms, providing you with a more manageable monthly payment. I recommend consulting with a financial advisor to find the best refinancing options that could potentially support your goal to repay your personal loan faster.

Tips for Accelerating Your Repayment

For many, repaying a personal loan can feel overwhelming, but I have found that there are practical steps to take that can help you become debt-free more quickly. Here are some tips that have proven to be effective: How To Repay Your Personal Loan Faster

- Make extra payments whenever possible

- Refinance your loan to secure a lower interest rate

- Utilize windfalls such as tax returns or bonuses to pay off your loan

- Set up automatic payments to avoid late fees and penalties

- Consider **debt snowball** or **avalanche methods** for systematic repayment

Recognizing these options can significantly reduce the time it takes to repay your personal loan.

Budgeting Effectively

If you want to repay your personal loan faster, it is necessary to start by **budgeting effectively**. You need to track your income and expenses to identify how much you can allocate towards your loan each month. With a well-thought-out budget, you can prioritize your loan repayment without compromising on your necessary needs.

Cutting Unnecessary Expenses

Some expenses may seem trivial, but cutting unnecessary ones can free up cash for your loan repayment. Examine your current spending habits to identify where you can make reductions, whether it’s dining out less or canceling unused subscriptions.

Cutting out these non-necessary expenses can provide you with additional funds each month. You might be surprised at how much you can save just by eliminating daily luxuries or opting for more affordable options. This approach not only accelerates your loan repayment but also fosters a sense of discipline in managing your finances.

Increasing Your Income

Accelerating your repayment can be greatly aided by **increasing your income**. This might involve taking on a part-time job, freelancing, or even selling items you no longer need. The extra cash can be directed solely towards your loan, significantly reducing your balance.

With a proactive approach to maximizing your earnings, you can tremendously enhance your repayment strategy. I have discovered that even small amounts can add up; for example, dedicating one weekend a month to freelance work or turning a hobby into a side hustle can lead to substantial savings. This ultimately gets you closer to being debt-free, showcasing how your determination can bring about positive financial change.

Factors to Consider When Repaying a Loan

After taking out a personal loan, there are several factors that I need to consider to ensure timely repayment and minimize long-term costs. Here are some factors that can significantly impact my repayment strategy:

- Interest Rates

- Loan Terms

- Financial Goals

- Income Stability

- Other Financial Obligations

- Prepayment Penalties

Recognizing these factors will help me make informed decisions about my repayment plan.

Interest Rates

With interest rates playing a major role in the total cost of my loan, it’s crucial for me to pay attention to whether my rate is fixed or variable. A higher interest rate means greater repayment costs, so finding ways to lower it or make extra payments can greatly benefit my financial situation.

Loan Terms

Even the length of my loan—its loan terms—can impact my repayment schedule. Shorter terms generally result in higher monthly payments but lower overall interest costs, while longer terms might ease my monthly budget but increase total interest paid.

Another thing to keep in mind is that choosing the right loan term can help me manage my cash flow effectively. I can tailor my repayment timeframe to match my financial capability, ensuring that I don’t spread my obligations too thin over a long period. Balancing the monthly payment with the total interest incurred is key to finding the ideal repayment plan for myself.

Financial Goals

Even my overarching financial goals are crucial when considering how quickly I want to repay my loan. It’s important for me to ensure that my repayment plan aligns with my other financial ambitions, such as saving for a home or retirement.

The success of my financial journey depends on my ability to balance my loan repayment with my other financial goals. If I prioritize a shorter repayment term, I might have less cash flow for savings or investments. Thus, carefully evaluating how to manage my loan while still pursuing my aspirations is vital for my overall financial health.

Summing up

Drawing together the strategies we’ve discussed, I believe that repaying your personal loan faster requires a proactive approach. By prioritizing extra payments, considering refinancing for lower interest rates, and budgeting effectively, you can significantly reduce your loan’s duration and interest costs. It’s vital to stay disciplined and motivated on this journey—every extra effort counts. Do not forget, the goal of being debt-free not only eases financial stress but also opens new opportunities. Take charge of your finances, and you’ll reach that goal sooner than you think!

One thought on “How To Repay Your Personal Loan Faster”