How To Prepare For A Personal Loan Application Credit is a vital aspect of securing a personal loan, and understanding how to prepare effectively can significantly improve your chances of approval. In this guide, I will walk you through the necessary steps you need to take, from checking your credit score to gathering the necessary documentation. I want to ensure you are well-equipped to present yourself as a trustworthy borrower, ultimately unlocking the doors to favorable loan terms and conditions that could positively impact your financial future. Let’s dive in and make your loan application process as smooth and successful as possible.

Table of Contents

Understanding Personal Loans

The process of applying for a personal loan can be daunting, but a solid understanding of personal loans will help you navigate it effectively. For a comprehensive guide, you can refer to this resource on How to Get a Personal Loan in 7 Steps.

What is a Personal Loan?

Clearly, a personal loan is a type of unsecured loan allowing you to borrow a fixed amount of money to finance various expenses, such as debt consolidation, home improvements, or unexpected expenses. You typically repay the loan in fixed monthly installments over a set period.

Types of Personal Loans

There are several types of personal loans that you can consider based on your financial needs. Here are the main types:

| Secured Personal Loans | Loans backed by collateral, such as a car or property. |

| Unsecured Personal Loans | No collateral is required, but higher interest rates may apply. |

| Debt Consolidation Loans | Use to combine multiple debts into a single loan, often with a lower interest rate. |

| Bad Credit Personal Loans | Designed for borrowers with poor credit but may carry high interest rates. |

| Peer-to-Peer Loans | Loans funded by individual investors through online platforms. |

After considering these options, I recommend you carefully evaluate which loan type fits your financial situation and goals.

Loans come with their pros and cons. While they can provide immediate financial relief, it’s important to be aware of the interest rates and repayment terms attached to each type. Here’s more on the risks and benefits of personal loans:

| Low Interest Rates | Some personal loans offer competitive rates, especially for good credit. |

| Flexible Use of Funds | You can use the money for various purposes, giving you flexibility. |

| Potential for Debt Accumulation | If not managed well, taking out loans can lead to greater debt. |

| Requires Good Credit | Better credit scores can lead to better terms and lower rates. |

| Origination Fees | Some lenders charge fees that can increase the overall loan cost. |

After considering these factors, it’s crucial to research your options thoroughly before applying for a personal loan. Understanding these details will help ensure you make informed and beneficial financial decisions.

Key Factors to Consider

Some important factors to consider when preparing for a personal loan application include:

- Credit Score

- Debt-to-Income Ratio

- Loan Terms

- Interest Rates

Perceiving these elements will significantly improve your chances of a successful application.

Credit Score Importance

With a high credit score, you are likely to have better loan options and favorable rates. This score reflects your creditworthiness and can determine whether you get approved for a loan or not. Improving your credit score before applying is a crucial step in the process.

Debt-to-Income Ratio

Assuming you understand your debt-to-income ratio is vital. This figure compares your monthly debt payments to your gross monthly income, giving lenders insight into your financial health. A lower ratio indicates that you have more available income to repay the loan.

Credit utilization plays a significant role in calculating your debt-to-income ratio. Striving for a ratio below 36% is generally recommended, as it indicates responsible borrowing habits. If your ratio is too high, lenders may perceive you as a risk, which could hinder your loan application.

Loan Terms and Interest Rates

There’s always room for confusion regarding loan terms and interest rates. These can significantly impact your monthly payments and the overall cost of the loan. Understanding the differences between fixed and variable rates is crucial before making a decision.

To secure the best possible deal, I recommend comparing various lenders and their offers. Remember that even a small difference in interest rates can lead to thousands of dollars in savings over the life of the loan. Make sure to read the fine print and fully understand the terms before signing any agreement.

How to Prepare for Your Application

Many people overlook the important steps needed to prepare for a personal loan application. Taking the time to gather your documents and assess your financial situation can greatly improve your chances of approval and ensure you receive favorable terms. How To Prepare For A Personal Loan Application

Gather Necessary Documentation

Clearly, I need to collect necessary documents such as my ID, proof of income, and any existing financial obligations. Having these documents ready will streamline the application process and help lenders evaluate my financial situation accurately.

Check Your Credit Report

Gather my credit report from major credit bureaus to review my credit score and any outstanding debts. Understanding what lenders will see allows me to address any inaccuracies or issues beforehand, ultimately giving me a better chance at securing a favorable loan.

Your credit report provides valuable insight into your financial behavior. By carefully reviewing it, I can identify any discrepancies that may affect my application. If I find errors, I should dispute them promptly, as correcting these could significantly improve my credit score and strengthen my application.

Determine Your Loan Amount

The next step is to decide how much money I truly need to borrow. I should evaluate my financial goals and identify the exact reasons for seeking a loan to avoid borrowing more than necessary.

Check my budget and calculate how much I can comfortably repay each month. By setting a realistic loan amount, I can not only improve my chances of approval but also ensure that I am not overextending myself financially, which could lead to serious repercussions down the line.

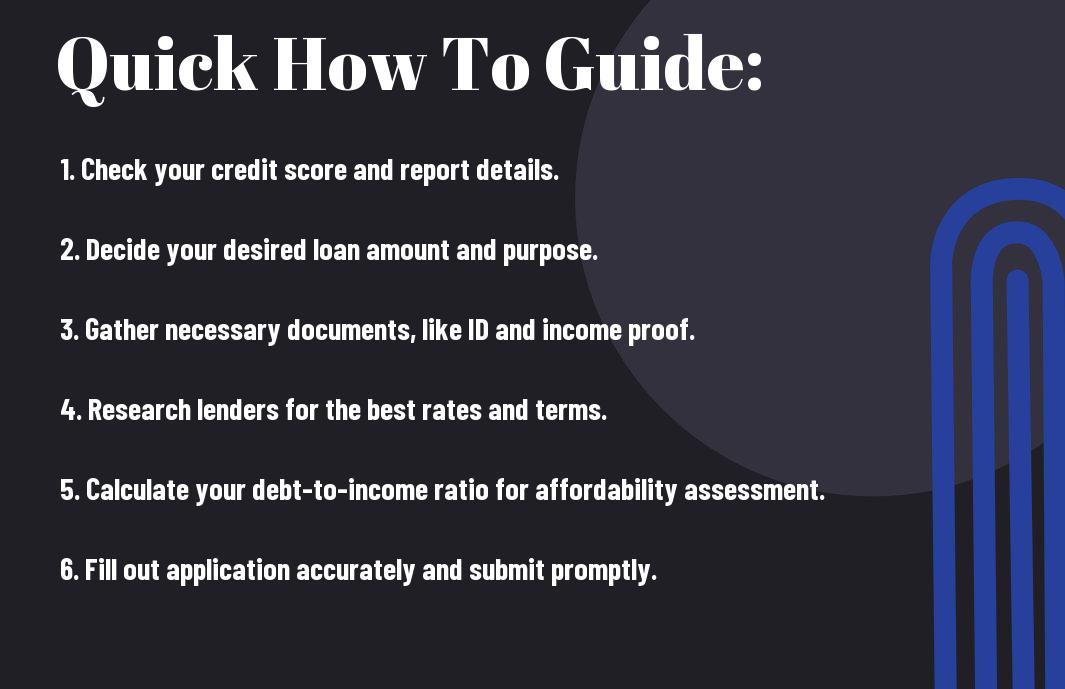

Tips for a Successful Application

Once again, preparing for a personal loan application requires careful thought and strategic planning. To enhance your chances for success, consider the following tips:

- Check your credit score and understand your credit report.

- Gather necessary documentation like income proof and identification.

- Determine your loan amount and repayment ability.

- Shop around for the best loan terms and interest rates.

- Maintain good credit behavior leading up to your application.

After implementing these tips, you will feel more confident when submitting your application.

Choosing the Right Lender

With so many lenders available, it’s crucial to choose the one that fits your financial needs best. Look for lenders who offer competitive interest rates, favorable terms, and good customer service. I recommend reading reviews and exploring your options to ensure you’re making an informed decision.

Avoiding Common Mistakes

Successful loan applications are often derailed by avoidable mistakes. Always double-check that you’ve filled out your application accurately and completely, as missing information can lead to delays or denials. I have learned that even minor errors can jeopardize your chances.

Right now, it is important to recognize the most common mistakes that applicants make, such as failing to review their credit history before applying or not having a clear understanding of the loan terms. I find it crucial to stay aware of these pitfalls, as they can significantly impact your overall experience and approval odds. Paying attention to detail and thoroughly preparing can safeguard you from these setbacks.

Timing and Pre-Approval

With appropriate timing and applying for pre-approval, you can streamline your application process. It’s advisable to apply when your financial situation is stable, and you’ve got all your documents ready. This foresight can save you time and stress.

The right timing is crucial when applying for a personal loan. I discovered that applying for pre-approval not only gives you a clearer picture of what you can borrow but also enhances your credibility with lenders. If you know how much you can potentially secure, you can make more informed decisions and better negotiate terms with your preferred lender.

To wrap up

With these considerations in mind, I believe that preparing for a personal loan application is vital to enhance your chances of approval and ensure favorable terms. By assessing your credit score, gathering necessary documentation, and understanding the loan terms, you can approach the application process with confidence. Remember to evaluate your budget carefully to confirm that the loan fits your financial situation. By following these steps, you can navigate the lending landscape more effectively and secure the funds you need.

3 thoughts on “How To Prepare For A Personal Loan Application”