How To Navigate Complex Business Loans Just like any entrepreneur, I know that navigating complex business loans can feel like trying to find your way through a maze blindfolded. You might think it’s impossible, but I’m here to tell you that with the right strategies, you can secure the funding your business needs without getting lost in the process. In this guide, I’ll break down the vitals of understanding your options, avoiding traps, and making smart financial decisions that will propel your business forward. Let’s dive in and get you on the path to financial success!

Table of Contents

Understanding Complex Business Loans

Before exploring into the nitty-gritty of complex business loans, it’s important to grasp their unique characteristics and intricacies. This understanding will set the stage for making informed decisions that can play a pivotal role in your business’s financial journey.

What Defines a Complex Business Loan

You need to recognize that a **complex business loan** isn’t your run-of-the-mill financing option. These loans often come with intricate terms, varied interest rates, and may require extensive documentation. If you’re looking at alternative funding sources like **private equity**, **mezzanine financing**, or even **venture capital**, you’re stepping into the complex side of business loans.

Key Factors to Consider

To make the most of a **complex business loan**, you must focus on several key aspects. Important factors include:

- Loan Terms

- Interest Rates

- Repayment Plans

- Collateral Requirements

- Fees and Costs

Any decision you make will affect your bottom line significantly, so keep an eye on these elements.

Business loans can be convoluted, and you need to dig deep into the fine print. Each of these **key factors** will impact your cash flow and financial health. Understanding things like:

- Amortization Schedule

- Prepayment Penalties

- Variable vs. Fixed Rates

- Financial Covenants

- Funding Timeline

Any oversight could lead to unexpected costs or financial strain down the line. So, don’t just skim the surface—dive deep! Get into the mindset of ‘how does this all fit’ into my overall business strategy.

How to Evaluate Loan Options

Now, figuring out which loan options best suit your business dreams can be a bit overwhelming. But trust me, you’ve got to take it step by step if you want to get it right. You need to align your financial goals with the most suitable loan products available. It’s all about understanding where you stand and where you want to go.

Assessing Your Business Needs

With every business, the needs are unique, and I can’t stress this enough—know your numbers! What do you need the funds for? Is it for expansion, equipment, or maybe tackling cash flow issues? Assessing what you actually require will guide you in choosing the right loan that makes sense for your situation. Don’t let impulse take over; clarity is key!

Comparing Interest Rates and Terms

Comparing loan options isn’t just about picking a number you like; it’s about strategy. Every percentage point and term can significantly impact your bottom line. I want you to lay out the options—even if it feels tedious. Use a table to see the value clearly. You’ll thank yourself later!

Interest Rates & Terms Comparison

| Loan Option | Interest Rate / Terms |

|---|---|

| Option A | 5% interest / 5 years |

| Option B | 7% interest / 3 years |

| Option C | 6% interest / 7 years |

Business loan terms can be tricky, and it’s my mission to ensure you understand what each choice entails. For instance, lower interest rates can be *exciting*, but don’t overlook fees or penalties! Plus, the term length affects how much interest accumulates over time. You might think a longer term means smaller payments, but it could cost you *way more* in the long run. Dive deep into those fine details!

Loan Terms & Fees

| Loan Option | Fees and Conditions |

|---|---|

| Option A | Processing fee / No prepayment penalty |

| Option B | Higher processing fee / Prepayment penalty applies |

| Option C | Low processing fee / Flexible repayment terms |

In the end, being thorough about evaluating loan options can save you a lot of headaches down the road. You’re not just picking a loan; you’re laying the groundwork for your future success. So, remember: do your homework, compare freely, and always keep your *long-term game* in mind. Let’s get out there and make some moves!

Tips for Securing the Best Loan

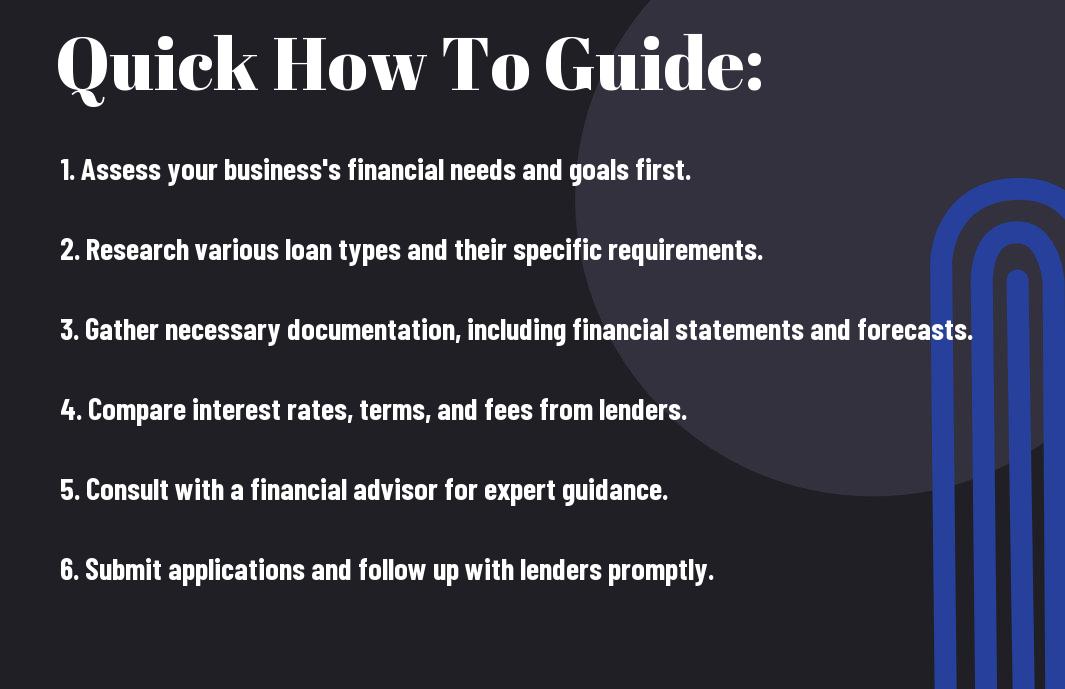

All small businesses face the daunting challenge of securing financing. However, with the right approach, you can increase your chances of obtaining a business loan that fits your needs. Here are some necessary tips to help you navigate this complex landscape:

- Understand your credit score and fix any discrepancies

- Prepare a detailed business plan that outlines your financial projections

- Compare interest rates and terms from multiple lenders

- Gather all necessary financial documentation

- Be transparent about your business finances

- Consider securing a personal guarantee

Perceiving these best practices will help you not only secure a loan but also create a strong foundation for your business’s financial future.

Strengthening Your Business Credit Profile

You want to ensure that your credit profile shines bright like a diamond when lenders check your score. Start by paying bills on time, managing credit utilization, and resolving any outstanding debts. Keep in mind that a solid credit profile shows lenders you are responsible and trustworthy, significantly improving your chances of getting a favorable loan.

Building Relationships with Lenders

Tips to build strong and lasting relationships with lenders include being conversational, transparent, and consistent. I believe that the key to success lies in developing a genuine rapport with your lender. Attend networking events, stay in touch, and share updates about your business. Recall, trust is built over time, and a solid relationship with your lender can lead to better loan terms, faster approvals, and increased access to capital.

Lenders appreciate borrowers who take the time to connect and share their business journey. When you demonstrate your expertise and passion for your business, they’re more likely to see you as a trustworthy candidate for funding. Engage with your lender openly—ask questions, provide updates—and show how your business is evolving. Strong relationships often lead to better loan terms and opportunities down the line. Be proactive and let your personality shine through; it could be the game-changer you need.

Conclusion

From above, navigating complex business loans isn’t just about crunching numbers; it’s about understanding your unique situation and making informed decisions that align with your vision. I’ve learned that the right loan can be a game changer for your hustle, so break it down, ask questions, and don’t be afraid to seek help. Do not forget, you’re building for your future, so leverage every resource you have to unlock opportunities. Keep pushing, stay authentic, and success will follow!

FAQ

Q: What are the key factors to consider when assessing different types of complex business loans?

A: When evaluating complex business loans, consider the following key factors:

Loan amount: Determine how much funding you need and ensure the lender can meet that amount.

Interest rates: Compare the interest rates offered by different lenders, including fixed vs. variable rates.

Terms and conditions: Pay attention to the repayment period, grace periods, and fees associated with the loan.

Collateral requirements: Check if the loan is secured or unsecured and what assets are needed as collateral.

Lender reputation: Research the lender’s history, customer reviews, and responsiveness to queries to gauge reliability.

Q: How can I improve my chances of getting approved for a complex business loan?

A: To enhance your likelihood of loan approval, consider the following steps:

Improve your credit score: Work on increasing your personal and business credit scores by paying bills on time and reducing existing debt.

Prepare a solid business plan: A comprehensive plan showcasing your business model, financial projections, and market analysis can demonstrate your preparedness.

Provide collateral: Offering valuable assets can reassure lenders and reduce their risk.

Show adequate cash flow: Lenders prefer borrowers who can demonstrate stable cash flow to cover repayments.

Build relationships: Establish connections with lenders by networking or consulting financial advisors who can advocate for your application.

Q: What are common pitfalls to avoid when navigating complex business loans?

A: Here are a few common pitfalls to be wary of:

Not reading the fine print: Failing to thoroughly understand loan terms, fees, and penalties can lead to costly surprises down the line.

Over-borrowing: Assess your actual needs and avoid borrowing more than necessary, which can lead to overwhelming debt.

Ignoring alternative options: Explore different funding sources, such as grants, equity financing, or crowdfunding, rather than defaulting to loans.

Rushing the process: Take your time to research and evaluate options; haste can lead to poor decisions that impact your business negatively.

Neglecting to seek professional advice: Consulting with financial advisors or accountants can provide insights that improve your loan strategy.