How To Guide For Navigating Home Loans Efficiently Home buying doesn’t have to be a nightmare, my friends! I’m here to show you how to navigate home loans like a pro, so you can grab that dream pad without the overwhelm. The process can be confusing and risky if you don’t know what you’re doing, but I’ll lay it all out for you step-by-step. With the right knowledge, you can make smart financial decisions that protect your wealth while securing the best mortgage deal. For even deeper insights, check out this useful resource on How To Get A Mortgage Step-By-Step!

Table of Contents

Understanding Home Loans

Before stepping into the intricacies of home loans, it’s crucial to have a fundamental grasp of what they are and how they can serve you.

What is a Home Loan?

Assuming you’re looking to finance your dream home, a home loan is a sum you borrow from a lender, intending to purchase real estate. You repay this loan over time with interest, using the property itself as collateral. It’s a powerful tool, but it’s vital to understand all aspects.

Types of Home Loans You Should Know

Home loans come in various forms, and knowing the right types can set you up for success. Here’s a streamlined overview of the main types:

| Loan Type | Description |

| Fixed-Rate Mortgage | Stable interest rate; consistent monthly payments. |

| Adjustable-Rate Mortgage (ARM) | Rates can change; often lower initial payments. |

| FHA Loans | Great for first-time buyers; lower down payment. |

| VA Loans | No down payment; exclusively for veterans. |

| Jumbo Loans | For high-value properties; often stricter criteria. |

Knowing the options available empowers you to choose the right loan for your financial situation and long-term goals.

Home loans can seem daunting, but understanding these types is your first step. As I mentioned earlier, types of home loans can significantly affect your financial future, and you want to make sure you’re informed and ready. Here’s a bit more information that might help you navigate through:

| Key Point | Importance |

| Interest Rates | Affects total repayment amount. |

| Loan Terms | Shorter terms can mean higher payments but less interest. |

| Down Payments | Higher down payments generally lead to lower monthly payments. |

| Credit Scores | Higher scores often secure better rates. |

| Fees | Closing costs can add up, so factor them in. |

Knowing these details ensures you’re not left in the dark when making a decision, and can save you thousands over the life of your loan. Recall, this is your investment; take charge of it!

Key Factors to Consider

Some of the most important decisions you’ll make revolve around home loans. As you investigate the purchasing process, I highly recommend keeping the following factors top of mind:

- Your Credit Score

- Interest Rates and How They Work

- Down Payment Requirements

Recognizing these elements will help you navigate through home loans much more efficiently.

Your Credit Score

Little do many realize how crucial your credit score is in the home loan process. It importantly acts like your financial blueprint, influencing the rate you can secure and the loan amount you qualify for. Knowing where you stand allows you to assess what you need to improve before jumping in.

Interest Rates and How They Work

Score! Understanding interest rates can be the difference between a good deal and a bad one. This is simply the cost of borrowing money, and it can fluctuate based on economic factors and your personal financial profile.

Credit scores play a massive role in setting the interest rate you’ll encounter. The lower your rate, the less you’ll pay over the life of the loan. Even a small percentage difference can lead to thousands of dollars in savings! So don’t underestimate the power of shopping around or switching loans if necessary. Finding that sweet spot is crucial for your financial health.

Down Payment Requirements

An important element to consider is the down payment. This is typically a percentage of the home’s purchase price that you need to pay upfront, and it can vary widely depending on the lender and type of loan.

Understanding the down payment requirements can be a game changer. Some loans allow as little as 3% down, but remember, a larger down payment can not only lower your monthly payments but could also help you avoid pesky private mortgage insurance (PMI). Think wisely about how much you can afford, as the right down payment can set the tone for a successful loan experience!

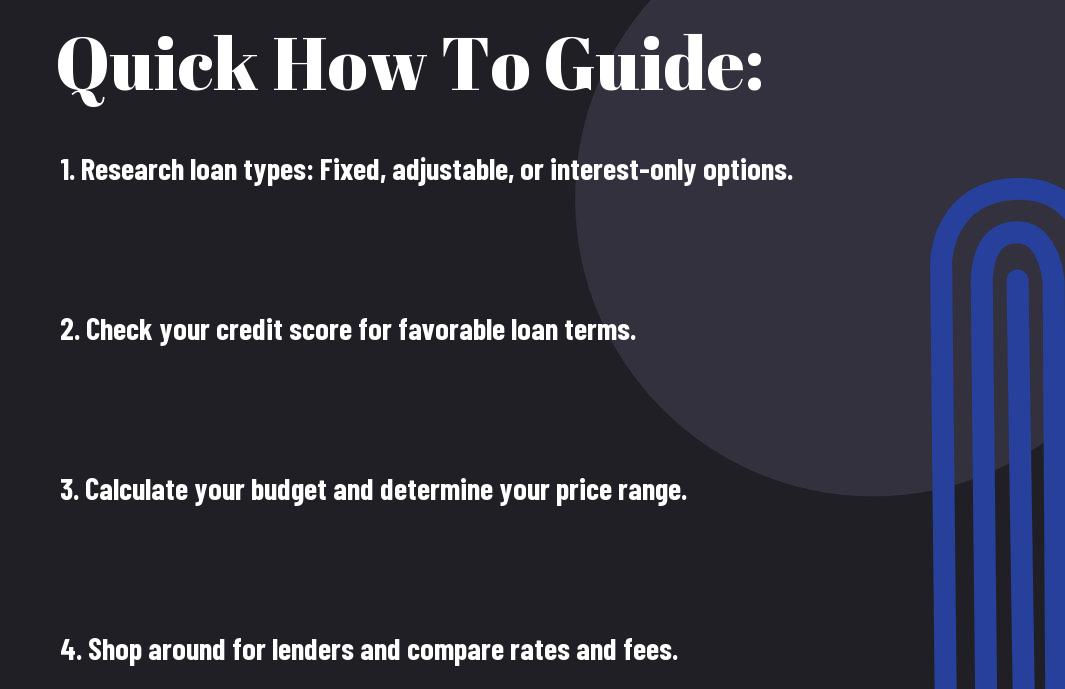

How-To Tips For Securing the Best Loan

Unlike many people, I’ve learned that navigating the home loan process can be a game-changer when it comes to securing your financial future. Whether you’re a first-time homebuyer or looking to refinance, here are some tips that can help you secure the best loan possible:

- Boost Your Credit Score: Improve your credit rating before applying.

- Save for a Down Payment: Aim for at least 20% to avoid private mortgage insurance (PMI).

- Shop Around: Compare offers from various lenders.

- Understand Loan Types: Get familiar with fixed-rate vs. adjustable-rate mortgages.

- Negotiate Fees: Don’t be afraid to ask for lower closing costs.

After all, the right mortgage can make owning a home not only possible but also exciting!

Researching Lenders

How To find the right lender is crucial for getting the best loan possible. Start by checking online reviews and ask for recommendations from friends and family. Make sure to look for lenders that offer personalized service and have a good track record in home loans, you’ll want someone who will guide you through the entire process seamlessly.

Comparing Loan Offers

Lenders often offer different rates and terms, making it crucial to compare loan offers. Start by gathering offers from at least three different lenders to see which one gives you the best overall deal.

Comparative Breakdown of Loan Offers

| Lender | Interest Rate |

|---|---|

| Lender A | 3.5% |

| Lender B | 3.25% |

| Lender C | 3.75% |

Not only should you look at the interest rates, but also consider the loan terms, fees, and how much down payment you need. That’s what ensures you’re making an informed decision that aligns with your financial goals. How To Guide For Navigating Home Loans Efficiently

The Importance of Pre-Approval

For serious homebuyers, getting pre-approved for a loan is crucial. This not only gives you a clear idea of your budget but also demonstrates to sellers that you’re a serious contender in the bidding war for your dream home.

Offers from pre-approved loans put you in a stronger position when making a purchase; they highlight your financial confidence. By showing that you have your financing figured out, you may even negotiate a better price or terms. This is crucial in today’s competitive market, so don’t overlook its importance!

Conclusion

Taking this into account, navigating home loans doesn’t have to feel like climbing a mountain. I want you to approach it with confidence, knowing I’ve shared the crucial steps to make this journey efficient and effective for you. By staying informed, evaluating your options, and understanding your finances, you can turn what seems complicated into a straightforward process. So, grab this knowledge, hustle with intention, and you’ll be on your way to owning that home you’ve dreamed about. Let’s crush it together!

One thought on “How To Guide For Navigating Home Loans Efficiently”