How To For Securing Affordable Home Loans Over the years, I’ve learned that securing an affordable home loan is not just a dream, it’s a power move in building your future. If you’re feeling overwhelmed, don’t sweat it—I’ve got your back. I’ll guide you through strategies and insider tips to navigate the sea of options, avoiding the traps that can cost you big time. Ready to take control of your financial destiny? Let’s dive in!

Table of Contents

Understanding Affordable Home Loans

The world of home financing can be overwhelming, but understanding affordable home loans is key to making a smart investment. Affordable home loans refer to financing options that allow individuals to purchase or refinance a home without straining their financial resources. These loans typically feature lower interest rates, reduced down payment requirements, and favorable terms designed to make homeownership accessible for a broader range of people.

What are Affordable Home Loans?

If you’re looking to buy a home without breaking the bank, **affordable home loans** might be your golden ticket. These loans are tailored for those who may meet certain eligibility criteria like income limits or credit thresholds. They can come in different forms like FHA, VA, or USDA loans, all designed to assist borrowers in securing a home at a manageable cost.

Key Factors That Affect Your Loan Options

Affordable home loans come with specific criteria, and understanding the key factors that affect your loan options is necessary. Some of these factors include:

- Credit score: A higher score can secure better terms.

- Income level: Your earnings impact loan eligibility.

- Debt-to-income ratio: This measures your financial responsibility.

- Employment stability: Lenders prefer applicants with steady jobs.

Assume that you take the time to analyze these factors; they can significantly influence your financing journey and ultimately your quest for an affordable loan.

Affordable loans aren’t just about the interest rates; they are also about the overall **financial landscape** you present to lenders. When I look at my financial situation, I consider various elements that can enhance my chances of securing a good loan:

- Down payment size: More cash down can lower your monthly payments.

- Loan type: Different loans have different requirements and benefits.

- Local housing market: Variations can affect loan availability.

- Government assistance programs: Some programs can enhance affordability.

Assume that you get a clear understanding of these factors; you will be better positioned to negotiate for an affordable home loan that can lead to long-term financial success.

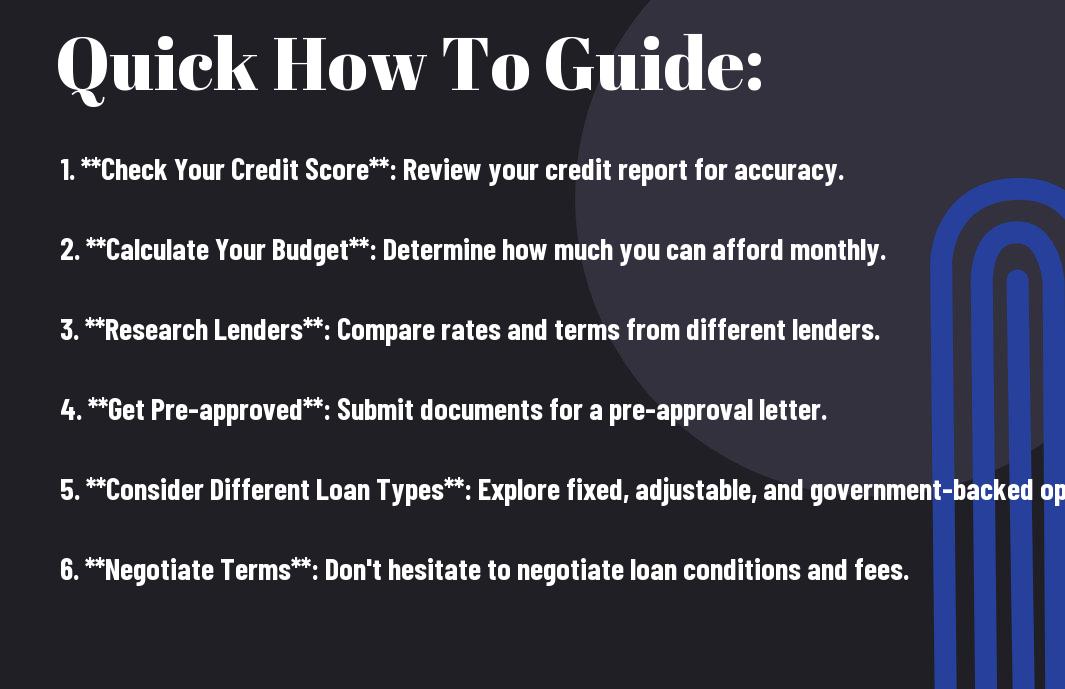

How to Prepare for Home Loan Applications

Some people underestimate the importance of prepping before plunging into a home loan application. I can’t stress enough how vital it is to really know your financial situation before you even think about applying. This means crunching the numbers, understanding your debts, and getting a clear picture of your income. The goal here is to identify any potential roadblocks that could hinder your chances of getting that loan approval. When you’re equipped with this knowledge, you can tackle the process with confidence.

Assessing Your Financial Health

Even if it feels overwhelming, I recommend taking a deep probe your financial landscape. Review your assets, liabilities, income, and expenses. A clear view of your financial health will not only prepare you for the application process but will also empower you to make informed decisions moving forward. Be honest with yourself—get real, and own it!

Improving Your Credit Score

Some people don’t realize how crucial a healthy credit score is for securing an affordable home loan. It’s like your financial report card, and trust me, lenders are looking at that before they decide if they’ll work with you. Improving your credit score can make a huge difference in the interest rates you get.

Understanding the components of your credit score is key to making improvements. Factors such as your payment history, credit utilization, and the length of your credit history all play a critical role. I recommend checking your credit reports regularly—if you spot any errors, dispute them immediately. Pay down high credit card balances to lower your utilization ratio, and make all your payments on time. Recall, building a better score takes time, but the rewards are absolutely worth it when you’re applying for a home loan. You’ve got this! pin code tool

Tips for Finding the Right Lender

Unlike the overwhelming chaos of a Black Friday sale, finding the right lender should be a strategic and well-thought-out process. You don’t want to end up with a mortgage that feels like a weight tied around your ankles for years. Here are some key strategies to help you choose wisely:

- Research and read reviews about potential lenders.

- Consider local lenders along with big banks for more affordable options.

- Get pre-approved to understand how much you can afford.

- Ask about any hidden fees involved.

- Compare service responses to find a lender who makes you feel valued.

Knowing what questions to ask can make a massive difference in your lending experience.

Comparing Mortgage Options

Options abound when it comes to choosing the right mortgage. You need to sift through them methodically to find a lender that meets your needs. Here’s how you can break it down:

Mortgage Comparison Table

| Type of Mortgage | Interest Rate |

| Fixed Rate Mortgage | Locked-in Rate |

| Adjustable Rate Mortgage | Variable Rate |

| FHA Loans | Lower Rates for First-Time Buyers |

| VA Loans | No Down Payment Required |

Understanding Different Types of Loans

The different types of loans can be crucial in steering your financial future. You need to grasp these concepts to take an informed step forward:

- Fixed Rate Loans maintain the same interest rates for the entire duration.

- Adjustable Rate Mortgages are often appealing but can become risky with market fluctuations.

- FHA loans are government-backed and perfect for those with limited credit histories.

- VA loans offer amazing perks for veterans, such as no down payment and competitive rates.

- Renovation loans can help you purchase and improve a fixer-upper, making it possible to achieve your dream home.

Any loan type you consider has its own pros and cons, so dive deep into the details.

Types of Loans Breakdown

| Loan Type | Key Features |

| Fixed Rate Mortgage | Stable Payments and Interest Rates |

| Adjustable Rate Mortgage | Initial Low Rates; Risks of Future Changes |

| FHA Loans | Government-Backed, Lower Down Payments |

| VA Loans | No Down Payment Required for Veterans |

| Renovation Loans | Finance Purchase and Rehab in One Loan |

Understanding the ins and outs of these loans will empower you to make a decision that aligns well with your long-term financial goals. Do your homework, and you’ll set yourself up for success! Any missed opportunity can lead to a detour in your home-buying journey.

Securing the Best Affordable Home Loan

For anyone looking to buy a home, finding the right loan can feel like searching for a needle in a haystack. I know, it’s a hustle, but it’s totally worth it. I’m here to tell you that negotiating terms and rates can be a game-changer in ensuring you land an affordable home loan that works for your financial situation.

Negotiating Terms and Rates

If you’re not asking for better terms, you’re leaving money on the table! I’ve gone toe-to-toe with lenders and learned that simply asking can lead to lower interest rates and better loan conditions. Be willing to walk away from a deal that doesn’t serve you, and you’ll find the right fit.

Utilizing Government Programs and Incentives

Programs designed to help first-time homebuyers are often underutilized. I’ve seen many folks miss out on incredible subsidies and tax incentives. By tapping into these resources, you can significantly cut down on costs and make homeownership more achievable.

Utilizing government programs can open doors you didn’t even know existed. These initiatives often provide low-interest loans, grants for down payments, and tax credits specifically for first-time buyers. Investigating your options can make a world of difference in your mortgage landscape, ultimately allowing you to snag that dream home without breaking the bank. Note, knowledge is power, so dig into these programs and leverage them to your advantage!

To wrap up

Upon reflecting on securing affordable home loans, I firmly believe it’s all about being informed and proactive. You have the power to explore various options, from government programs to first-time buyer incentives that can save you money. Be mindful of, your financial journey is personal, and taking the time to learn about First-Time Homebuyer Loans, Special Programs, and How … can make a huge difference. Stay curious, hustle hard, and you’ll find the right loan that fits your ambitions!

One thought on “How To For Securing Affordable Home Loans”