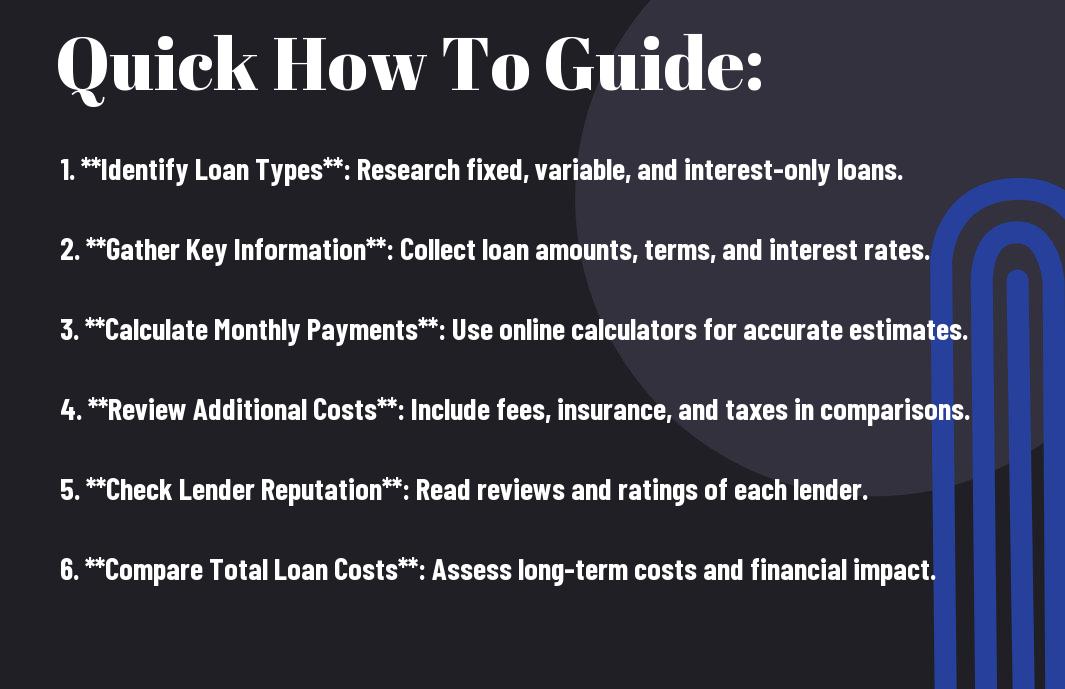

Comparing Different Home Loans Over the years, I’ve seen way too many people jump into home loans without doing their homework, and that can seriously cost you—I’m talking about thousands of dollars in the long run! That’s why I’m here to break it down for you. In this post, I’ll walk you through important steps to help you compare different home loans effectively. Trust me, understanding your options is key to finding the best fit for your budget. For a deep dive, check out this guide on How to Compare Mortgage Loan Offers—it’s a game changer!

Table of Contents

How to Gather Your Home Loan Options

Before entering into the world of home loans, you need to know how to effectively gather your options. This will set you up to make informed decisions later. Trust me, you don’t want to wing it. Having a solid foundation will give you the leverage you need to compare and ultimately choose the right home loan. Let’s break it down. pin code tool

Research Different Lenders

Even the best home loan can fall flat if you pick the wrong lender. I’m telling you, not all lenders are created equal. Some will surprise you with hidden fees while others will give you excellent customer service. Start by looking for reputable lenders, either local or online, and check their reviews. Don’t just settle; ask around and do your homework.

Understand Loan Types

Loan types can feel overwhelming, but understanding them is a game changer. I mean, would you invest in stocks without knowing the fundamentals? This is no different. You’ve got options like fixed-rate mortgages, adjustable-rate mortgages, and FHA loans. Here’s a quick breakdown to keep it simple:

| Loan Type | Description |

| Fixed-Rate | Stable monthly payments for the life of the loan. |

| Adjustable-Rate | Initial low rates that can change over time, potentially increasing your payment. |

| FHA Loans | Government-backed, easier for first-time buyers. |

| VA Loans | No down payment for veterans, great benefit. |

| USDA Loans | No down payment for rural areas, awesome for qualifying buyers. |

Loan options will significantly impact your monthly budget and long-term financial health. It’s crucial to grasp the differences. Think about your financial situation, how long you plan to stay in a home, and your tolerance for risk. The more you know, the better equipped you are to choose wisely. Knowing your loan options empowers you to make a savvy choice.

>.

Home loans not only shape your financial future but also dictate your lifestyle. So I need you to stay informed. Don’t let the jargon throw you off. Here are some vital details about the different home loan types:

| Key Factors | What to Look For |

| Interest Rates | Higher rates mean higher payments; keep it low. |

| Term Length | 15 vs. 30 years can affect your total cost. |

| Down Payment | Higher down payment means lower monthly payments. |

| Fees | Look for origination fees or closing costs. |

| Flexibility | Can you pay off early without penalties? |

Home loans may not be sexy, but they’re crucial for your financial journey. Take the time to understand the ins and outs, and you can save thousands in the long run. Stay sharp, learn every detail, and you’ll position yourself for success. Knowing what you’re dealing with transforms this intimidating process into manageable steps!

Tips for Evaluating Loan Offers

Assuming you’ve received a handful of home loan offers, it’s key to examine each one like you’re on a treasure hunt. Here are some tips I’ve found useful when it comes to evaluating those offers:

- Check Interest Rates carefully.

- Compare Fees and Closing Costs side by side.

- Look closely at Loan Terms.

- Evaluate the Loan Duration you prefer.

- Assess Prepayment Penalties if applicable.

This kind of analysis will set you up for making a well-informed decision!

Check Interest Rates

Clearly, the interest rate is a crucial element of your loan. Even a slight difference can add up to thousands over the life of the loan. Make sure you’re comparing the rates on an equal basis, as even a 0.25% change can significantly impact your monthly payments and total interest paid.

Compare Fees and Closing Costs

While the interest rate is important, the fees and closing costs can often sneak up on you. It’s necessary to scrutinize the details because sometimes lower rates come with higher fees. Check what each lender includes in their closing costs and find out the true cost of getting that loan.

Fees and Closing Costs Breakdown

| Item | Typical Charges |

|---|---|

| Appraisal Fee | $300 – $700 |

| Title Insurance | $500 – $3,000 |

| Origination Fee | 1% – 3% of the loan amount |

| Inspection Fees | $200 – $500 |

Fees can often add up quickly, so it’s necessary to not just glance over them. Understanding the different components in fees will save you from getting blindsided later, which is why I emphasize digging deeper into each line item. The total of your closing costs should be factored into whether you’re really getting a good deal!

Look at Loan Terms

Clearly, different loan terms can dramatically affect your overall financial picture. It’s not just about the interest rate; you’ll also want to understand how long you’ll be paying this loan off and if it aligns with your financial goals.

Understanding the terms of the loan will help you weigh options more effectively. Are you looking at a 15-year term versus a 30-year loan? A shorter term might come with higher monthly payments but less total interest paid over the life of the loan. Alternatively, a longer term can lower your monthly payment but may result in much more interest over time. Make sure to grasp these nuances to avoid any costly mistakes!

Key Factors to Consider

All potential homebuyers should understand that comparing different home loans is about more than just interest rates. Here are some critical factors I think you should keep in mind:

- Interest Rates – Always get clear on how they impact your total payment.

- Monthly Payments – Make sure these fit into your budget comfortably.

- Loan Term – Short-term vs. long-term; know what works for you.

- Prepayment Penalties – Watch out for fees that could hurt you later.

- Flexibility of the Loan – Some loans offer options for adjustments.

Perceiving these factors will help you make an informed decision that aligns with your financial goals.

Monthly Payments and Affordability

While it might be easy to only focus on the interest rates, you need to evaluate the monthly payments and overall affordability. This means diving deep into your budget to ensure the mortgage won’t stretch your finances too thin. You want peace of mind in your monthly expenditure!

Prepayment Penalties

Some loans come with prepayment penalties, which can trap you if you plan to pay off your mortgage early. This is why understanding the specific terms of your loan is critical for your financial strategy.

Prepayment penalties are fees that lenders impose when you pay off your loan earlier than agreed. I want you to imagine this: you have the chance to pay off your mortgage and save thousands, but then you get smacked with a fee that takes away your gains. That’s just not cool. Always read the fine print and know what you’re getting into.

Flexibility of the Loan

Some loans provide a level of flexibility that can help you adjust your payment terms as your financial situation evolves. This is crucial; life can throw curveballs, and you need options that can adapt.

To make the most of your loan, look for ones that offer flexibility, such as the ability to refinance without hefty fees or adjust payment terms if your income jumps or drops. It’s about having a mortgage that fits your life, not the other way around.

Summing up

Following this guide, I’ve armed you with the tools to compare home loans effectively. You gotta break down the interest rates, terms, and fees to find the perfect fit for your financial goals. Take control of your future by analyzing those numbers, talking to lenders, and asking the tough questions. Recall, it’s your money, your home—so hustle hard and don’t settle for less! Get out there, and make those comparisons work for you!

One thought on “Quick How To Steps For Comparing Different Home Loans”