How To Guide For Boosting Your Home Loan Approval Chances Home ownership is a game-changer and I know you want to secure that dream, but getting your home loan approved can feel like an uphill battle. Trust me when I say you can dramatically improve your chances with a few simple strategies. In this guide, I’m going to walk you through imperative steps that can help you put your best foot forward and avoid dangerous pitfalls that could derail your application. Let’s dive in and turn your homeownership dreams into a reality!

Table of Contents

How to Prepare Your Finances

Before I started the home buying process, I realized that preparing my finances was a crucial step. I needed to ensure that I was in the best position possible before applying for a loan. So, let’s dig into the vitals that can really make a difference.

Analyze Your Credit Score

Now, the first thing I did was check my credit score. It’s the backbone of your financial profile and lenders use it to gauge how risky you are as a borrower. A score above 700 is generally considered good, while below 600 could hurt your chances. This is where I made my move to improve!

Reduce Outstanding Debts

You absolutely need to focus on reducing your outstanding debts. Lenders want to see that you can manage your debts effectively, so bringing down credit card balances and paying off any loans can significantly increase your chances of approval.

This is crucial because the lesser your debts, the better your debt-to-income ratio becomes. If you can show lenders that you’re not over-leveraged with credit cards or loans, it’s a huge plus! And trust me, even paying off just a few smaller debts first can make you feel lighter and financially stronger.

Create a Detailed Budget

To ensure that I was on top of my finances, I created a detailed budget. This was key to understanding where my money was going and where I could make adjustments to save more for my home purchase.

Understanding my income and expenses helped me see where I could cut back on unnecessary spending. By tracking every dollar, I could allocate more towards savings, which made me feel more in control of my financial destiny. Do not forget, every little bit counts when it’s about landing that dream home!

Tips for Choosing the Right Loan

Now, let’s get down to brass tacks on how to choose the right loan for your needs. This step is crucial because the right loan can make all the difference in your home buying journey. Here are some tips to keep in mind:

- Consider your financial situation.

- Look into various loan types.

- Evaluate interest rates.

- Check loan terms.

- Analyze additional costs.

Any misstep in this process could result in unfavorable terms, so be sure to dig deep into all your options. For further insights, check out Will You Get Approved for a Mortgage? | 2024.

Research Different Loan Options

Loan options are abundant, but not all of them will suit your needs. I suggest that you take time to research various types of loans available in the market. From fixed-rate to adjustable-rate to FHA loans, knowing each loan’s pros and cons will empower you to make an informed decision that aligns with your financial goals.

Understand Interest Rates

Understand that the interest rate on your loan can significantly impact your monthly payments. I know firsthand that even a small difference can lead to tens of thousands of dollars in extra payments over the loan’s life. That’s why it’s crucial to grasp not just your current rate but also how it fits into the broader economy.

The factors that affect interest rates include your credit score, the type of loan, and broader market trends. You should closely monitor current rates and be in tune with shifts that could affect your mortgage costs. Be mindful of, locking in a low rate can save you big bucks in the long run.

Compare Lenders

Loan comparison is vital to find the best deal. I recommend you look beyond just the interest rates. I’ve found the total costs and customer service can be just as important. Here is a simple breakdown of what to compare:

Lender Comparison

| Lender Name | Interest Rate |

| Lender A | 3.5% |

| Lender B | 3.75% |

| Lender C | 3.25% |

Another aspect to probe is loan fees and customer service. Not only should you focus on interest rates but also on upfront fees, prepayment penalties, and how responsive the lender is to your queries. This will make a huge difference in your overall mortgage experience!

In the end, taking the time to evaluate your options can pay off tremendously. Do not rush this decision; give it the attention it deserves! Boosting Your Home Loan Approval Chances

Essential Factors to Consider

Keep in mind that there are several necessary factors to consider when boosting your home loan approval chances. I firmly believe that understanding these aspects can make a significant difference in your application process. Here are the key factors:

- Employment Stability

- Down Payment Amount

- Debt-to-Income Ratio

Employment Stability

You need to demonstrate that you have consistent and reliable income. Lenders look for employment stability because it shows you can pay back the loan. A steady job gives them confidence that you won’t default on your mortgage.

Down Payment Amount

An adequate down payment can greatly enhance your chances of securing a loan. The more you put down, the less risk you present to the lender, which can boost your approval odds significantly.

Plus, aiming for a down payment of at least 20% can help you avoid paying private mortgage insurance (PMI), resulting in lower monthly payments and overall loan costs. With a solid down payment, you also showcase your commitment to the purchase, which can impress lenders. It’s all about knocking their socks off with your readiness.

Debt-to-Income Ratio

Consider how much of your monthly income goes toward paying existing debts. Lenders use your debt-to-income (DTI) ratio to assess whether you can comfortably manage a new mortgage alongside your current obligations.

A lower DTI ratio – ideally below 36% – signals to lenders that you’re financially healthy and can handle additional debt. On the flip side, a high DTI can be a **red flag**, making lenders hesitant to approve your loan. Keep an eye on your debts and make smart financial moves to improve this ratio. The key is to show that you are responsible and ready to commit to that mortgage!

To wrap up

Drawing together everything I’ve shared, boosting your home loan approval chances isn’t rocket science—you just need to know the game. Don’t sit on the sidelines; get your paperwork in order, improve your credit score, and be transparent with your lender. Believe me, every detail matters when you’re trying to secure that dream home. With the right mindset and preparation, you can totally make this happen. So, push forward and own your journey, because your dream isn’t just a possibility; it’s your reality waiting to unfold.

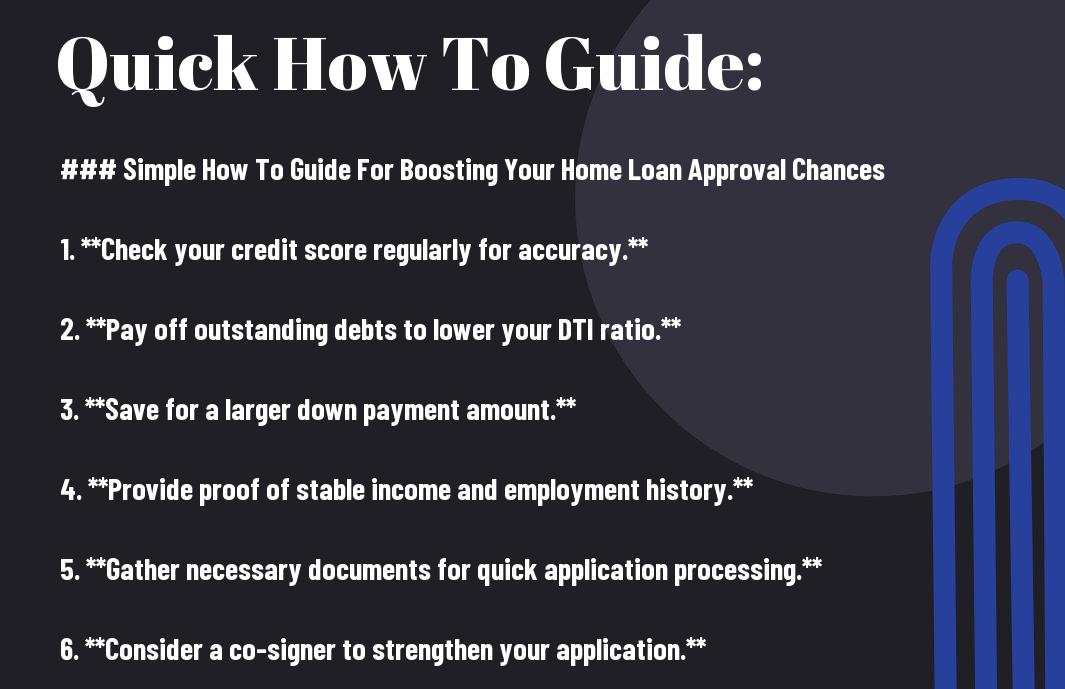

One thought on “Simple How To Guide For Boosting Your Home Loan Approval Chances”