Smart How To Strategies For First Time Home Loans strategies can make or break your journey to getting your first home loan. I’m here to guide you through the process, ensuring you avoid common pitfalls and seize the financial opportunities that come your way. You’ll learn how to boost your credit score, navigate the complicated paperwork, and leverage government assistance programs. Trust me, with the right approach, your dream home is within reach. Let’s jump in and conquer the world of home loans together!

Table of Contents

Understanding First-Time Home Loans

Your journey into homeownership starts with a solid understanding of **first-time home loans**. These loans are specially designed to assist individuals who are purchasing a home for the very first time, often featuring lower down payments and more favorable terms. This makes homeownership a reality for many people who might otherwise struggle to qualify for typical financing options.

What is a First-Time Home Loan?

For many people, a **first-time home loan** can be a game-changer. These loans are typically issued to buyers who haven’t owned a home in the last three years. Whether you’re looking for a cozy condo or a single-family home, these specialized mortgages often come with benefits that make it easier for you to step into the housing market. Smart How To Strategies For First Time Home Loans

Key Factors to Consider

To succeed in securing a **first-time home loan**, you’ll want to carefully evaluate a few key factors:

- Credit Score: Your score needs to be solid.

- Down Payment: The lower, the better, but don’t stress!

- Debt-to-Income Ratio: Keep it in check for better rates.

- Loan Type: Research different options—FHA, VA, or USDA could be game-changers.

Any missteps here and you could hit a snag.

The world of **first-time home loans** can feel overwhelming, but I’m here to break it down. Knowing your **credit score** is imperative; lenders want to see a healthy score since it reflects your financial responsibility. The **down payment** is your ticket to lower monthly payments, and while it may seem daunting, remember that some programs allow as low as 3% down! Balancing your **debt-to-income ratio** is crucial too, as lenders prefer ratios below 43%. Lastly, when considering the **loan type**, explore the options like **FHA loans** with their lower down payments or **VA loans** if you’ve served. **Any** hesitation in getting this info sorted could mean missing out on fantastic opportunities.

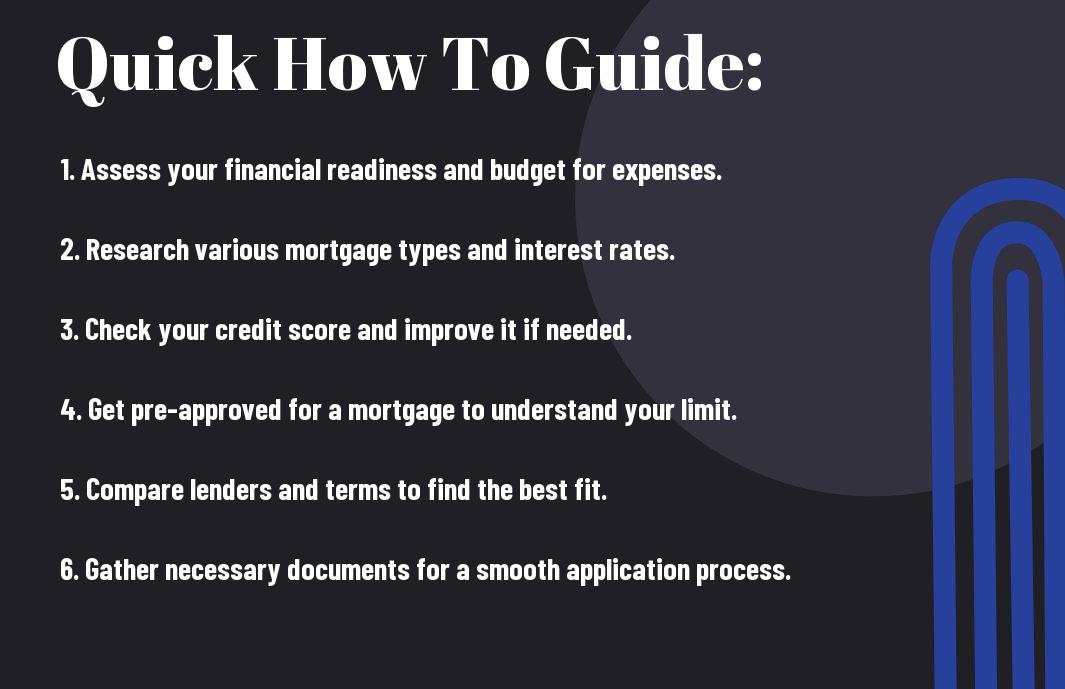

How to Get Started

Little do many first-time homebuyers know, understanding your finances is the first critical step in this exciting journey.

Assessing Your Financial Situation

Assuming you want to make a smart move, I always advise starting with a deep investigate your finances. Look at your income, monthly expenses, and any existing debts. You need to know your exact financial position because lenders will scrutinize it closely.

Gathering Necessary Documentation

Some of the most critical elements of securing a home loan are the documents you need to gather. These typically include pay stubs, bank statements, tax returns, and identification. Each lender will have specific requests, but these are the foundational pieces to get the ball rolling.

Assessing what you need to submit is necessary. Start by gathering your last two years of tax returns and your W-2 forms, along with a few months’ worth of bank statements showing your savings and spending patterns. Your lender is going to look for patterns in your financial habits, makes sure they’re seeing the best side of you. The smoother your documentation process, the smoother your home loan process will be. Trust me, being organized can save you time and headaches down the road!

Tips for Choosing the Right Loan

For first-time homebuyers, navigating the world of home loans can feel overwhelming. But don’t worry, I’m here to give you some killer tips to make the right choice for your needs. When you’re selecting a loan, consider the following:

- Understand your budget and what you can afford.

- Look into different types of loans: fixed-rate, adjustable-rate, etc.

- Research the terms and conditions thoroughly.

- Get pre-approved to know how much you can borrow.

- Check out interest rates from various lenders.

- Don’t ignore the importance of closing costs and fees.

- Compare loan features, including the length of the loan.

Assume that you take the time to weigh your options properly; you’ll be much more confident in your decision.

For an in-depth look at how to make the best choice, check out 7 Smart Tips for First-Time Home Buyers – Intercap Lending.

Comparing Different Loan Options

On your journey to homeownership, it’s crucial to compare the various loan options available. This helps you understand what suits your situation best while minimizing costs.

| Loan Type | Description |

|---|---|

| Fixed-Rate Mortgage | Stable interest rate throughout the loan term. Great for long-term planning. |

| Adjustable-Rate Mortgage | Lower initial rates that can change over time. Riskier but potentially cheaper. |

Seeking Help from Mortgage Professionals

Loan options can be complex, and that’s where mortgage professionals come into play. They can save you time and money by guiding you in finding the right **loan** for your specific situation.

Seeking help from mortgage professionals is one of the most empowering steps you can take. They have the expertise to break down your options and help you select a loan that meets your **financial** needs. You might think you’re fine handling it all on your own, but trust me—this is where their knowledge can save you from making some **dangerous** mistakes. Consider them your financial allies; they can help you navigate tough **terms**, make sense of your credit score implications, and ultimately, find you a loan with favorable **rates** and conditions.

To wrap up

The key to navigating first-time home loans is to arm yourself with the right strategies—never underestimate the power of knowledge and planning. I’ve seen too many people dive in without the necessarys, and that’s a recipe for stress. You have the ability to leverage what you learn, evaluate your options, and make informed decisions. Don’t just rely on others; take charge of your financial future. You’ve got this! Now go out there, crush it, and turn that dream into your own reality!

One thought on “Smart How To Strategies For First Time Home Loans”