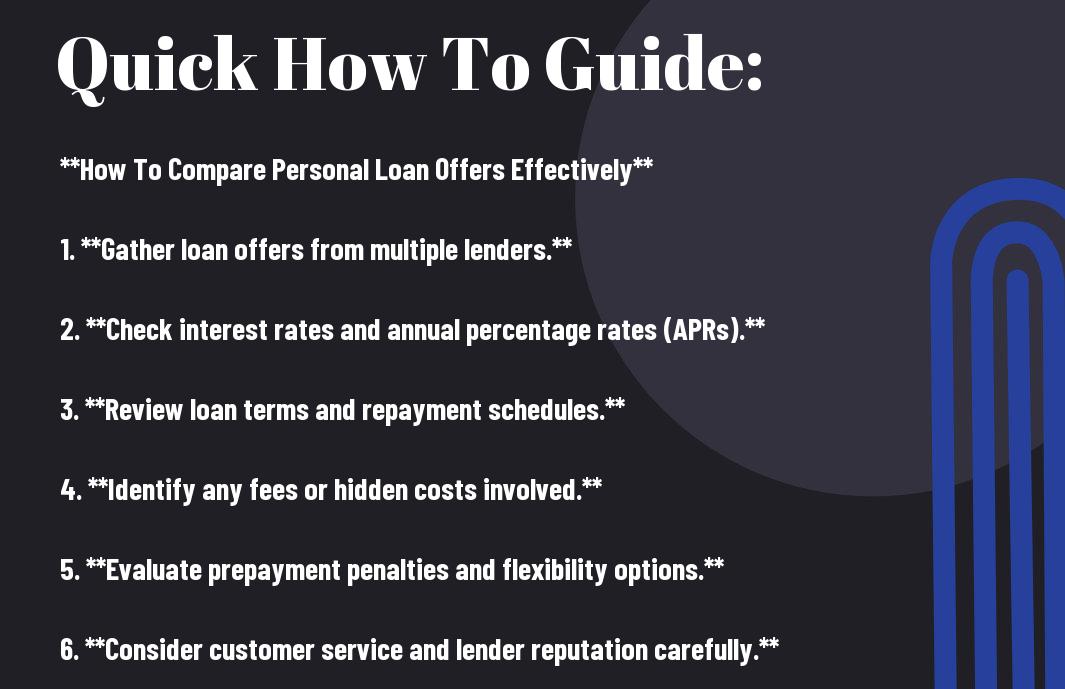

How To Compare Personal Loan Offers Effectively Compare personal loan offers effectively to ensure you’re making the best financial decision for your needs. I know that navigating through various terms, interest rates, and fees can be overwhelming. However, by understanding key factors such as APR, loan terms, and hidden fees, you can avoid costly mistakes. In this guide, I’ll walk you through a step-by-step process to evaluate your options confidently, helping you secure a loan that not only meets your financial goals but also saves you money in the long run.

Table of Contents

Understanding Personal Loans

While navigating the world of personal loans can be overwhelming, it’s crucial to grasp the basics before plunging into offers. Personal loans are a type of unsecured financing that allows you to borrow a fixed amount of money to meet various financial needs. To effectively compare personal loan offers, I recommend starting by Personal Loan Rates: Compare Top Lenders in August 2024, which can provide insights into current market trends and lender options.

Types of Personal Loans

There are several distinct types of personal loans tailored to various financial needs:

- Secured Personal Loans: These loans are backed by collateral, which can lower your interest rate.

- Unsecured Personal Loans: No collateral is required but typically have higher interest rates.

- Fixed-Rate Loans: Your interest rate remains constant throughout the loan term.

- Variable-Rate Loans: Rates can fluctuate based on market conditions.

- Debt Consolidation Loans: Designed to consolidate multiple debts into a single payment.

Knowing which type of loan best suits your situation is key to making an informed decision.

| Loan Type | Key Features |

| Secured | Backed by collateral, lower rates |

| Unsecured | No collateral, higher rates |

| Fixed-Rate | Constant interest rate |

| Variable-Rate | Rates may fluctuate |

| Debt Consolidation | Combine multiple debts |

Interest Rates Explained

There’s much to understand about interest rates when it comes to personal loans. These rates determine how much additional money you’ll repay on top of the principal amount borrowed, and they usually vary based on several factors, including your credit score and loan term.

A clear understanding of interest rates is vital for making sound financial decisions. Generally, personal loans can have fixed or variable rates. A fixed rate means your payment stays the same, making budgeting easier. In contrast, a variable rate can change over time, potentially leading to higher payments if interest rates rise. The interest rate you qualify for significantly impacts the overall cost of your loan, so it’s vital to aim for the lowest possible rate based on your financial profile.

Key Factors to Consider

Even when faced with numerous personal loan offers, it’s necessary to focus on a few key factors that can significantly impact your decision. These factors help you compare and evaluate offers effectively to ensure you choose the best one for your financial situation. Below is a list of some crucial elements that I find critical to consider:

- Loan Amount and Duration

- Fees and Additional Costs

- Credit Score Impact

Thou can’t underestimate the importance of these factors in making an informed decision.

Loan Amount and Duration

Amount of the loan and its duration can greatly influence your repayment strategy. You should assess how much you need and for how long you can comfortably repay it. Choosing a shorter duration may increase your monthly payments but reduce the total interest paid, while a longer term will lower monthly costs but can lead to paying more in interest overall.

Fees and Additional Costs

Even a small fee can add up and affect your overall loan cost significantly. Be sure to consider not just the interest rate but also any origination fees, prepayment penalties, or other hidden costs that may arise. Scrutinizing the complete picture of what you’ll be paying will help you make an informed choice.

To avoid surprises, I recommend that you request a breakdown of all fees associated with the loan. This will include items like application fees, annual fees, and late payment penalties. By understanding all possible expenses, you can better gauge the true cost of borrowing and ensure you’re not caught off guard.

Credit Score Impact

Clearly, your credit score plays a significant role in determining the offers available to you. A higher score typically translates to lower interest rates and better terms, while a lower score may limit your options and result in higher costs.

The effects of applying for a loan can further influence your credit score. Each loan application can lead to a hard inquiry, which might temporarily decrease your score. Thus, it’s crucial to balance your need for borrowing with the impact on your creditworthiness. Be strategic and ensure you apply for loans that offer the best chance of benefiting you in the long run.

How to Compare Loan Offers

Keep in mind that comparing personal loan offers is critical to ensuring you find the best deal for your financial situation. Below are key elements you should focus on when evaluating different loan offers.

| Factor | Importance |

|---|---|

| Interest Rate | Determines your overall cost of borrowing. |

| Loan Amount | Must meet your financial needs without excess. |

| Loan Term | Your repayment duration and how it affects monthly payments. |

| Fees | May include origination fees, late payment fees, etc. |

Gathering Loan Offers

You should start by obtaining multiple loan offers from various lenders. Comparing numerous options will give you a clearer picture of the interest rates, terms, and conditions available to you. Consider using online comparison tools or contacting lenders directly to request personalized quotes.

Creating a Comparison Chart

If you want to effectively evaluate the various aspects of each loan offer, I suggest creating a comparison chart. This will help you organize the vital details of the loans you’re considering and make it easier to spot the best options.

| Feature | Details |

|---|---|

| Interest Rate | Fixed or variable rate information. |

| Loan Amount | What you can actually borrow. |

| Repayment Terms | Length of time to repay the loan. |

| Monthly Payment | How much you’ll pay each month. |

Compare all relevant information from the loans side by side in your chart to easily identify which lenders offer the best conditions. You can adjust your chart based on personal preferences, such as prioritizing low monthly payments or short loan terms.

Evaluating Lender Reputation

On top of loan features, it’s imperative to evaluate the lender’s reputation. Look for reviews, ratings, and any feedback from current or past borrowers to gauge reliability and customer service quality.

Offers from established lenders often include more transparency and better customer support, which can significantly impact your borrowing experience. Additionally, check for any complaints or legal actions against the lender, as this could be a red flag. Making choices driven by a lender’s credibility can save you from potential future headaches.

Tips for Getting the Best Deal

To ensure you get the best deal on your personal loan, consider the following suggestions:

- Improve your credit score prior to applying.

- Shop around to compare different lenders.

- Look for loans without origination fees.

- Negotiate interest rates when possible.

- Understand the total cost of the loan, including fees.

This will help you make an informed decision and save money in the long run.

Negotiating Terms

You can often negotiate the terms of your personal loan to better fit your financial situation. Don’t hesitate to ask for lower interest rates or favorable repayment terms. Being prepared with information about competitive offers from other lenders can give you leverage in your discussions.

Timing Your Application

For the best results, time your application strategically. Lenders may offer better rates during certain periods, such as after a significant improvement in your credit score or during promotional events.

Timing your application can also help you secure a better deal. Be aware of economic factors that may influence loan rates, such as changes in the Federal Reserve rates. Additionally, if you’ve recently paid down credit card debt or improved your financial situation, applying at that moment can yield a more favorable outcome.

Understanding Prepayment Penalties

Any personal loan may come with prepayment penalties, which are fees you incur if you pay off your loan early. It’s important to read the terms carefully to avoid surprises.

Understanding these prepayment penalties can help you make a more informed decision. Some loans may have high penalties, which could negate the savings from paying off your loan early. Always ask potential lenders about these fees and consider them in your overall cost analysis.

Conclusion

Hence, comparing personal loan offers effectively empowers you to make informed financial decisions that align with your needs. By analyzing key factors such as interest rates, fees, repayment terms, and lender reputations, I can ensure that I find the best loan for my situation. As you gather and evaluate this information, remember that the goal is to secure favorable loan terms that set you up for success. Always take the time to ask questions and clarify any doubts before committing to a loan offer.