How To Refinance Your Business Loans Successfully Just because you took out a business loan doesn’t mean you have to live with the terms forever—this is your opportunity to take control! I’m here to share my best strategies to refinance your business loans successfully. It’s all about finding better rates, understanding your financial situation, and making moves that will positively impact your bottom line. Let’s examine the steps you need to take to ensure you’re making the most out of your financial decisions and setting your business up for long-term success!

Table of Contents

Understanding the Refinancing Process

For anyone looking to take control of their business loans, it’s crucial to understand the refinancing process. Refinancing your business loan can provide numerous advantages, from lower interest rates to better cash flow management. If you’re considering this path, check out How To Refinance A Business Loan In 5 Steps to get started.

What is Business Loan Refinancing?

On the surface, business loan refinancing involves replacing your existing loans with a new one, ideally with more favorable terms. It’s about leveraging better interest rates or altering your repayment schedule to improve your financial health.

When to Consider Refinancing

On a practical level, there are specific circumstances that might prompt you to consider refinancing your business loans. I mean, if you’ve been in business for a while and have seen improved credit scores or market conditions, that’s a sign it might be time to revisit that loan!

Business owners should really pay attention to the signs that indicate a potential refinancing opportunity. If your current interest rate is sky-high and new options available are significantly lower, you’re losing money every month. Also, if your cash flow is stable, you might just qualify for a loan with better terms. On the flip side, if you find yourself juggling multiple payments, consolidating those debts through refinancing can streamline your finances, making it easier to focus on growth instead of stress. Do not forget, it’s all about improving your financial situation so you can invest back into your business and crush it!

Key Factors to Evaluate Before Refinancing

If you’re considering refinancing your business loans, there are several key factors to evaluate that can make or break this decision. Understanding these can help you secure a better deal and improve your cash flow. Here’s what to consider:

- Current Interest Rates

- Your Business Credit Score

- Loan Terms and Conditions

Current Interest Rates

If current market conditions indicate that interest rates are lower than when you initially took out your loans, refinancing could lead to significant savings. A small percentage drop can translate into substantial monthly savings over the life of the loan.

Your Business Credit Score

With your business credit score, the stronger it is, the better rates you can secure when refinancing. Lenders use this score to assess your creditworthiness, which heavily influences their decision.

Plus, maintaining a high business credit score is crucial for favorable refinancing terms. I recommend regularly checking your credit report and addressing any discrepancies. Be mindful of, a solid score not only boosts your refinancing chances but also reflects your business’s financial health.

Loan Terms and Conditions

To make a smart refinancing decision, you must closely analyze the loan terms and conditions associated with your current and potential new loans. These factors can significantly impact your finances down the line.

Refinancing can provide you with opportunities to adjust loan terms, such as the duration or repayment schedules, which might allow you to lower your monthly payments. However, be cautious of any hidden fees or unfavorable conditions that can undermine your savings. The goal is to streamline your financial obligations while enhancing your business’s cash flow. Be mindful of, it’s vital to crunch the numbers and not enter a deal that could cost you more in the long run. The key is to stay informed and cautious while making your decision.

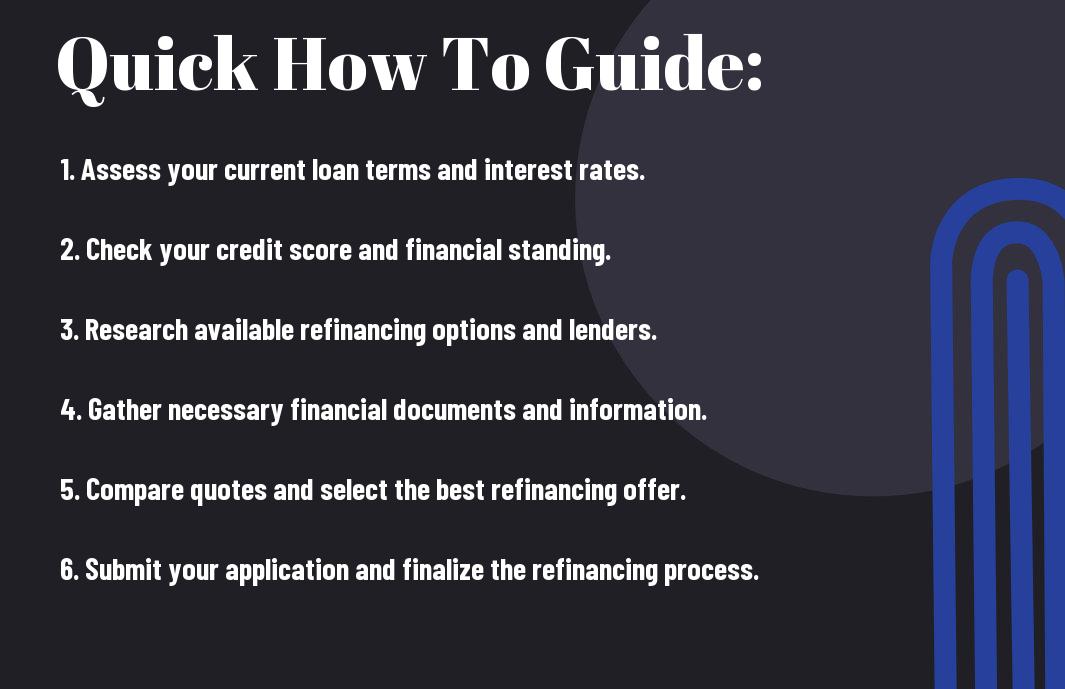

How to Successfully Refinance

Despite the complexities of refinancing, it can be a game-changer for your business. You’ll want to make sure you approach this process with the right strategies and mindset.

Preparing Your Financial Documents

Little did I know, having your financial documents in order is absolutely crucial. Gather your tax returns, profit and loss statements, cash flow statements, and your business plan. Being organized can help you present your business in the best light, making you a more attractive candidate for lenders.

Researching Lenders and Options

Financial institutions vary significantly in what they offer and their underwriting criteria. Spend time researching different lenders, as each might have unique requirements and benefits that suit your needs. Compare not just interest rates but also payoff terms and fees.

For instance, you might find that some lenders specialize in certain industries and can offer tailored solutions that fit your unique business model. Don’t underestimate the value of community banks or credit unions; they’re often more flexible than larger institutions. Make a list of questions to ask lenders to ensure you fully understand their offers.

Applying for New Loans

Refinance applications can feel daunting, but approach them with confidence. Fill out your applications carefully, ensuring all your information is accurate and complete. A strong application can make all the difference in securing those favorable terms.

Another major tip is to be prepared for the lender’s due diligence process. They’ll dig into your business’s financial health, so make sure you’re ready to provide additional documentation, answer questions, and discuss your business’s potential. Don’t shy away from showcasing why you’re a great investment. This is your time to shine!

Tips for a Smooth Refinancing Experience

Not everything that looks good on paper is as easy as it seems, especially when it comes to refinancing your business loans. I’m here to share some critical tips that can lead you to a successful refinancing journey. Do not forget, meticulous planning can help avoid bumps along the way.

- Understand the current market conditions to get the best rates.

- Prepare a comprehensive financial statement to present your business’s strengths.

- Have a solid business plan ready to showcase future potential.

- Always look for hidden fees that can derail your refinancing costs.

- Establish strong communication with your lender to build trust.

Knowing these tips can enhance your odds of a successful refinancing process.

Avoiding Common Pitfalls

If you rush into refinancing without proper research, you could end up paying a heavy price. It’s crucial to avoid jumping at the first offer you receive. Understand your financial goals and carefully analyze the terms of any new loan, as this is where many people fall short and make missteps. How To Refinance Your Business Loans Successfully

Negotiating Better Terms

Pitfalls often arise when business owners don’t feel equipped to negotiate. You might see that interest rates are set in stone, but trust me, that’s not always true. Never underestimate the power of a good conversation. Most lenders are willing to work with you if you present your case effectively.

Avoiding a rigid mindset is key here. It’s about laying down your business’s achievements and future potential in a way that resonates with your lender. Researching market rates and similar loan options will give you leverage to negotiate better terms. Do not forget, every basis point counts!

Timing Your Application

Experience has shown me that timing can make or break your refinancing experience. If you submit your application at the wrong time, you might miss out on better rates or favorable conditions due to market fluctuations.

Tips for timing your application include analyzing economic trends and understanding your business’s cash flow cycles. Avoid applying during high-demand periods for loans or when your financial statements show inconsistencies. Selecting the right moment is going to save you stress, headaches, and money in the long run!

Conclusion

Upon reflecting, I realize that successfully refinancing your business loans is all about strategy and timing. I urge you to assess your current situation, understand your options, and take action that aligns with your business goals. Don’t be afraid to negotiate, leverage your relationships, and ask for what you deserve. You’ve got this! If I can drive my business forward with careful planning and execution, so can you. Now go out there and make that refinancing work for you!

FAQ

Q: What are the main reasons to refinance a business loan?

A: Refinancing a business loan can be beneficial for several reasons. Firstly, it can help lower your interest rate, which reduces your overall payment burden and can save you money over time. Secondly, it can improve cash flow by extending the loan term or switching to a different repayment structure. Additionally, refinancing may allow you to consolidate debt from multiple loans, simplifying your finances. Lastly, if your business’s credit rating has improved since taking out the original loan, you may be eligible for better terms, making refinancing a smart financial move.

Q: What steps should I take to prepare for refinancing my business loan?

A: Preparing to refinance your business loan involves several key steps. Start by assessing your current financial situation, including reviewing your credit score, business finances, and existing loan terms. Next, gather all necessary documentation, such as tax returns, financial statements, and your business plan. Research potential lenders and loan products that fit your needs. It’s also imperative to evaluate the costs associated with refinancing, such as origination fees or prepayment penalties on your existing loan. Finally, consult with a financial advisor or accountant to ensure that refinancing aligns with your business goals and cash flow strategy.

Q: How do I choose the right lender when refinancing my business loan?

A: Choosing the right lender for refinancing your business loan requires careful consideration of several factors. Start by comparing interest rates and fees from multiple lenders to find the most competitive offers. Assess the lender’s reputation by reading customer reviews and checking their standing with the Better Business Bureau (BBB). Look for lenders who specialize in business loans and have experience in your industry, as they may be more understanding of your unique circumstances. Additionally, evaluate the lender’s customer service, response times, and overall approach to business relationships. Finally, consider the flexibility of their terms and whether they offer additional services that could benefit your business in the future.